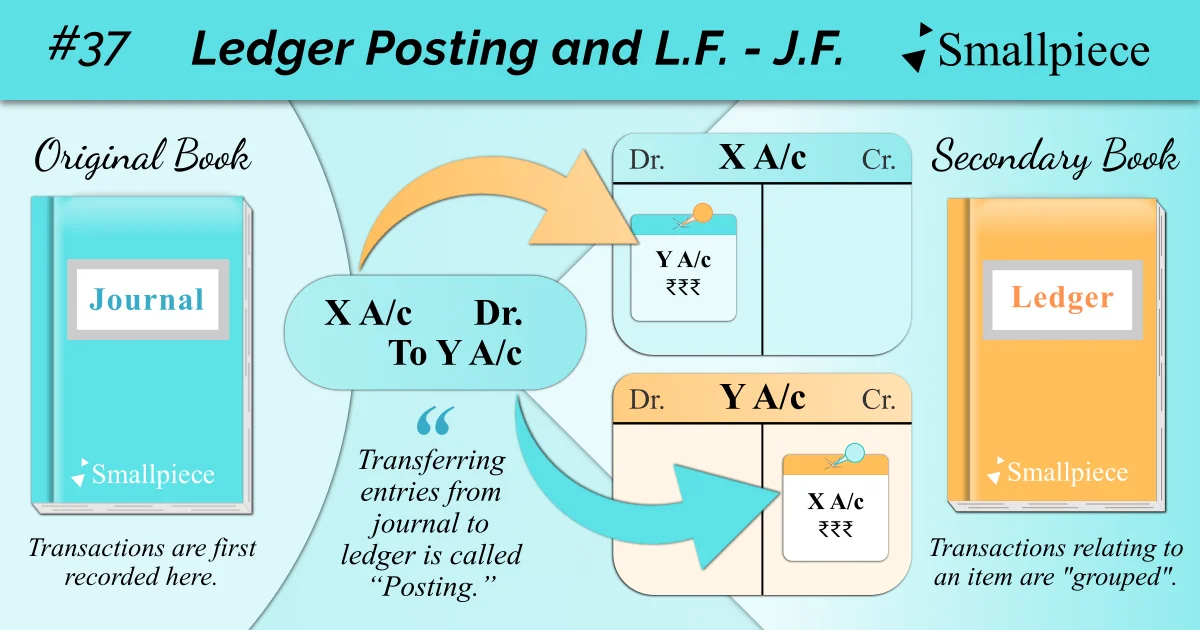

We know that journal entries are further sent / transferred to ledger for the purpose of easier calculations.

This very process of transferring entries from journal to the T-shaped accounts in ledger what we call posting.

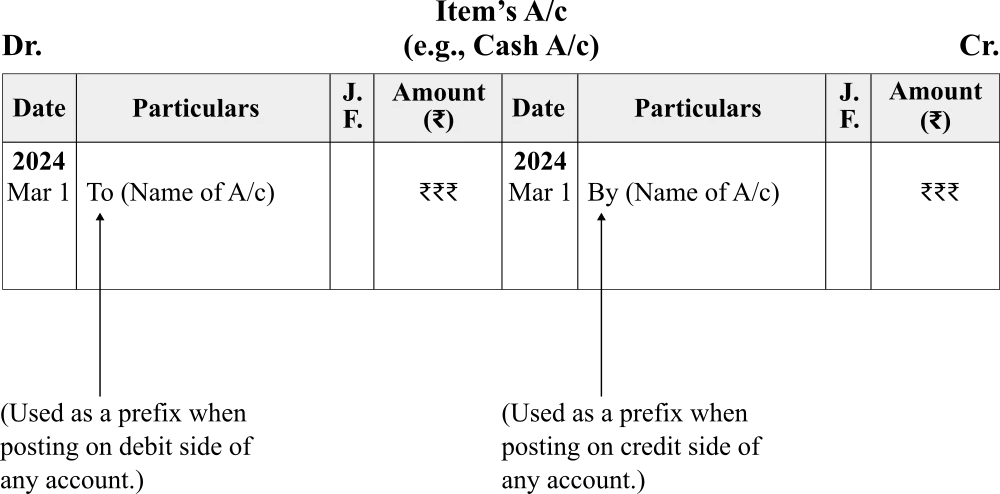

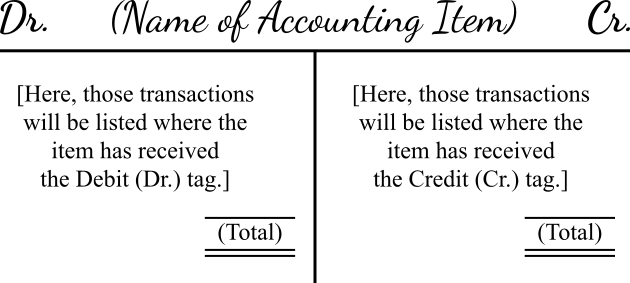

Proper Format of T-account:

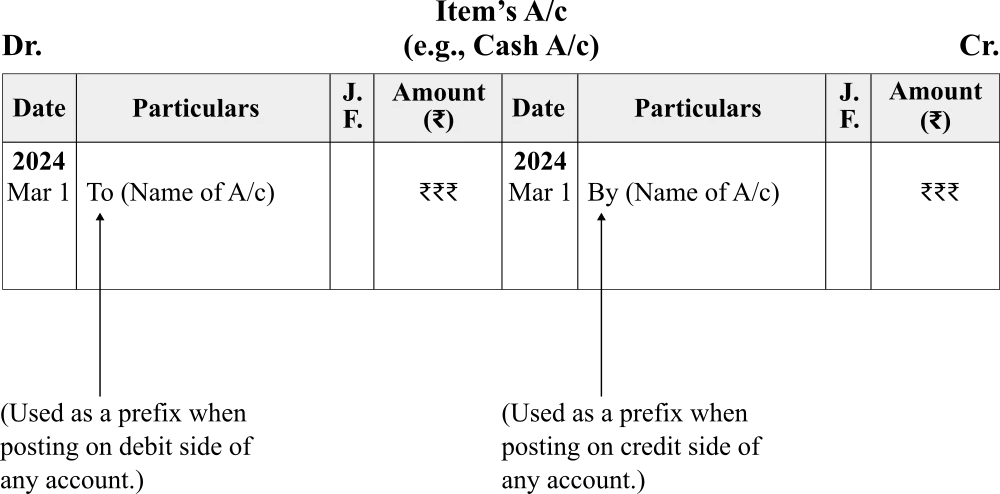

Till now, we have seen the rough format of a Ledger Account, otherwise known as a “T-Account”. Now, we must checkout the proper format and what columns are included on both sides of the ‘T’.

In Total, there are 4 columns on each side:

1. Date: self-explanatory.

2. Particulars: It is what you might call the ‘Specifics’ and what I call the ‘Reason’ column, where any recording is done with prefixes: ‘To’ for the left (debit) side and ‘By’ for the right (credit) side.

3. J.F.: short for Journal Folio, it is where we write the page no. of the journal entry which has been posted into the T-account.

L.F.: If you remember, while discussing the format of journal, I said that the ‘L.F.’ column will come much later in our series of discussions; the time has now come. Akin to J.F., L.F. which stands for ‘Ledger Folio’, is the page no. of the T-account of an item in Ledger where the journal entry has been posted.

4. Amount (₹): self-explanatory.

Now, how do we post entries into ledger? Let us take an example:

Example Posting:

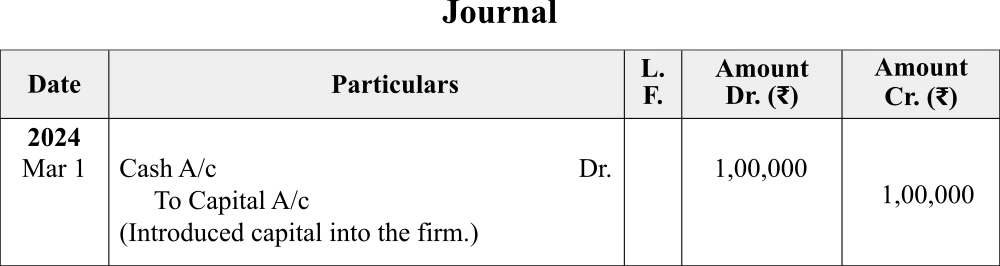

Mar 1, 2024: Introduced ₹ 1,00,000 capital and commenced business.

The journal entry for this is as follows:

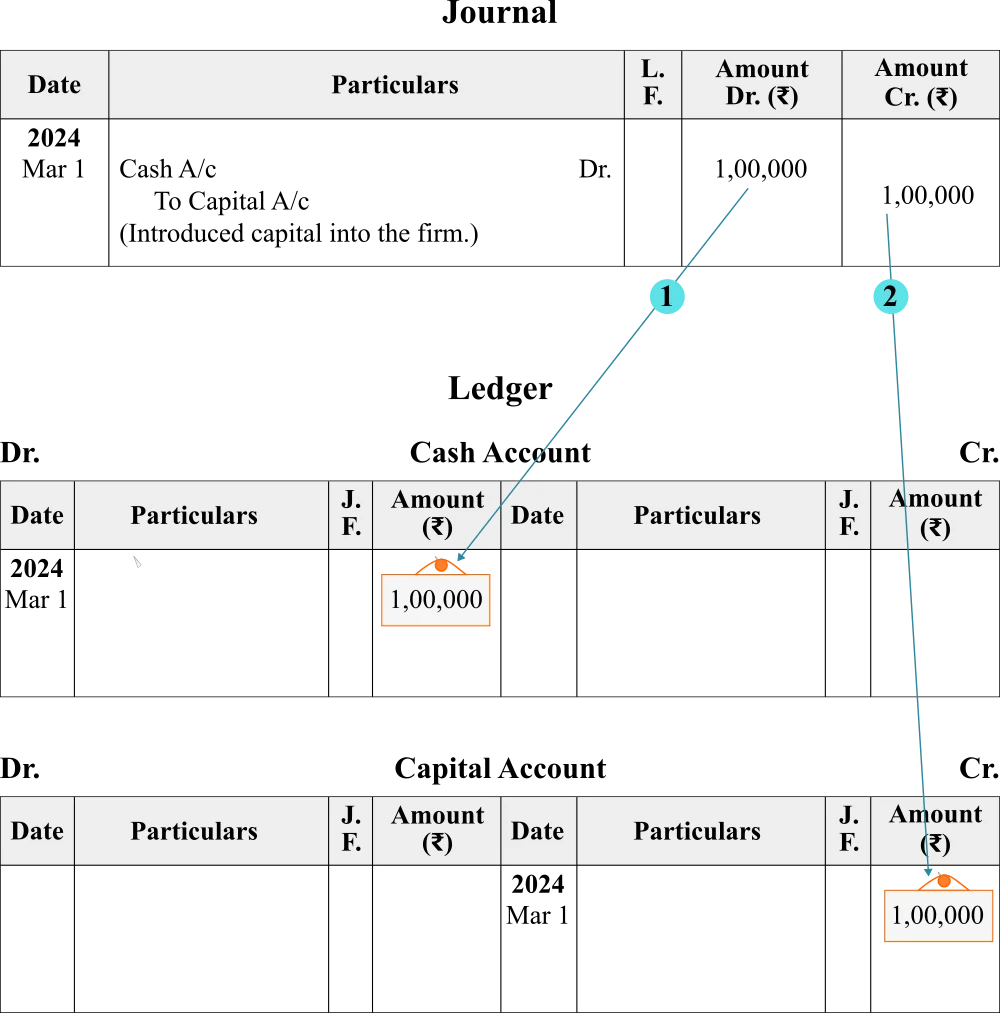

There are total 4 imaginary steps which will help us post this entry. We will be checking them out in pairs.

Step 1: Look at the item tagged debit, here, the Cash item which is accompanied by ‘A/c’ suffix because a part of the entry will be posted into the Cash Account in Ledger.

Since it has received the debit tag, we will focus on the debit (left) side of the Account, where we find a column for ‘Amount’. In this column, post the amount corresponding to the cash item in journal entry, i.e. ₹ 1,00,000.

Step 2: Repeat this procedure for the item tagged credit, here, Capital.

Look to the credit (right) side of the Capital Account in Ledger, where also we can locate an ‘Amount’ column. In here, post the amount corresponding to the Capital item in the journal entry, also ₹ 1,00,000.

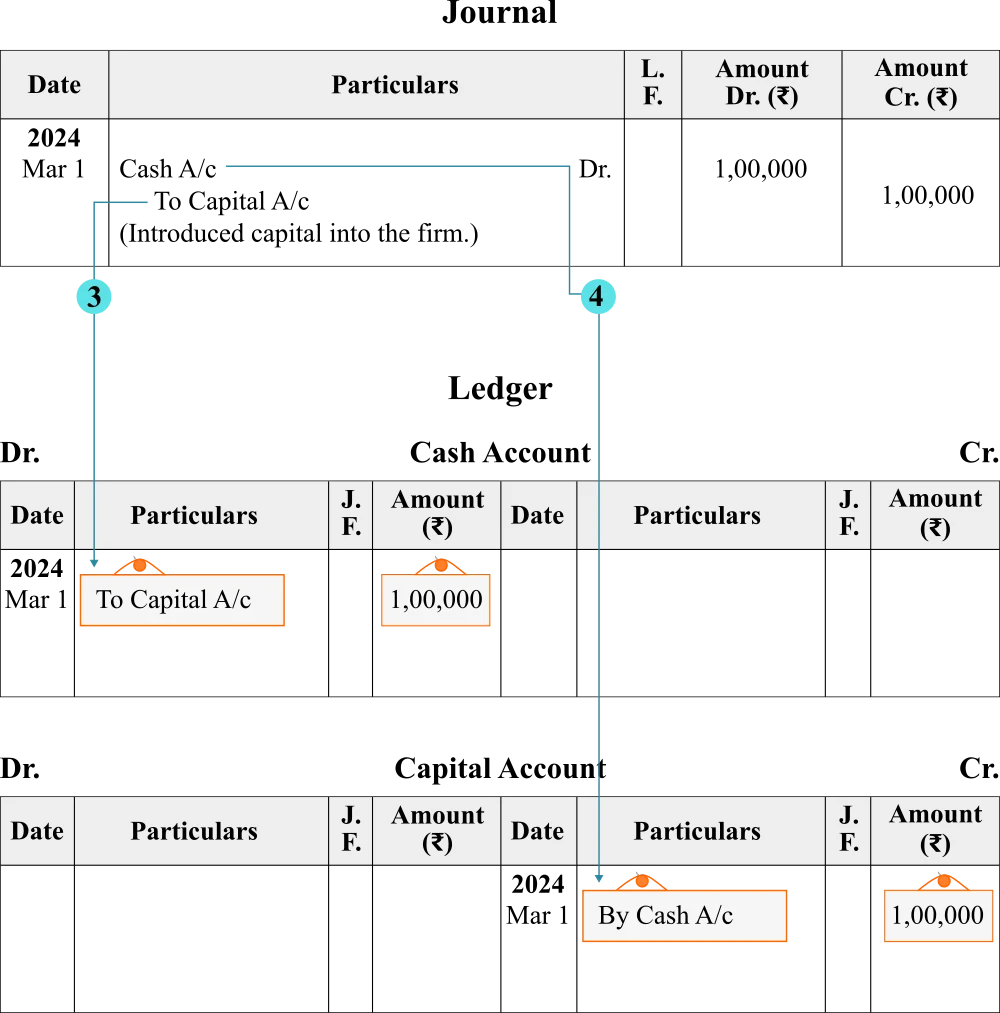

Step 3: Focus on the Cash Account in Ledger where we have posted the ₹ 1,00,000. Here, in the ‘Particulars’ column, or what I think of as ‘Reason’ / ‘Specifics’ column, we have to mention the reason for which ₹ 1,00,000 has been received and hence, debited.

It is, of course, on account of introduction of Capital to commence business. Thus, ‘Capital A/c’ is what we’ll write in the Particulars column with the prefix ‘To’.

Step 4: Repeat the same for the Capital Account in Ledger. Where on the credit side we have posted the ₹ 1,00,000, we can also locate a Particulars column. In here, we have to mention the specifics regarding the form in which capital has been introduced.

Capital, as the definition goes, is simply “owner’s amount invested into the business”. It may be in the form of hard cash or other assets like furniture, plant and machinery, etc. that he has directly brought to the business.

In our case, it is in the form of hard cash and hence, we write ‘Cash A/c’ with the prefix ‘By’.

There it is, we’ve successfully posted a journal entry into the T-accounts of the respective items in Ledger.

If you have noticed, just as debit and credit complete each other in accounting (the Dual Aspect Concept), the items receiving these tags in a journal entry form the reason / specifics mentioned in the T-accounts of one another: Cash A/c is mentioned in the ‘Particulars’ of Capital A/c and vice-versa.

Example Repeat – Hitesh Traders

We already have the Journal for Hitesh Traders.

Now, your task here is to prepare Ledger Accounts for Hitesh Traders and then, calculate the Profit/Loss for the same.

You already have the process and solution for the first entry (it is the example we saw above).

Try and post the other entries yourself after which, check out the full solution document as follows.

To aid your posting process, I’ve provided some references below: do use them.

Reference

1. Rough Format of a Ledger Account – Use this if you’d like. We aren’t in a class anyway.

2. Proper Format – Put some hard work at least once to get a proper grasp over the posting process and the account format.

3. Posting for Compound Entries – Entries which include more than two items or now ‘accounts’. Posting for such entries is illustrated in the document below:

Leave a Reply