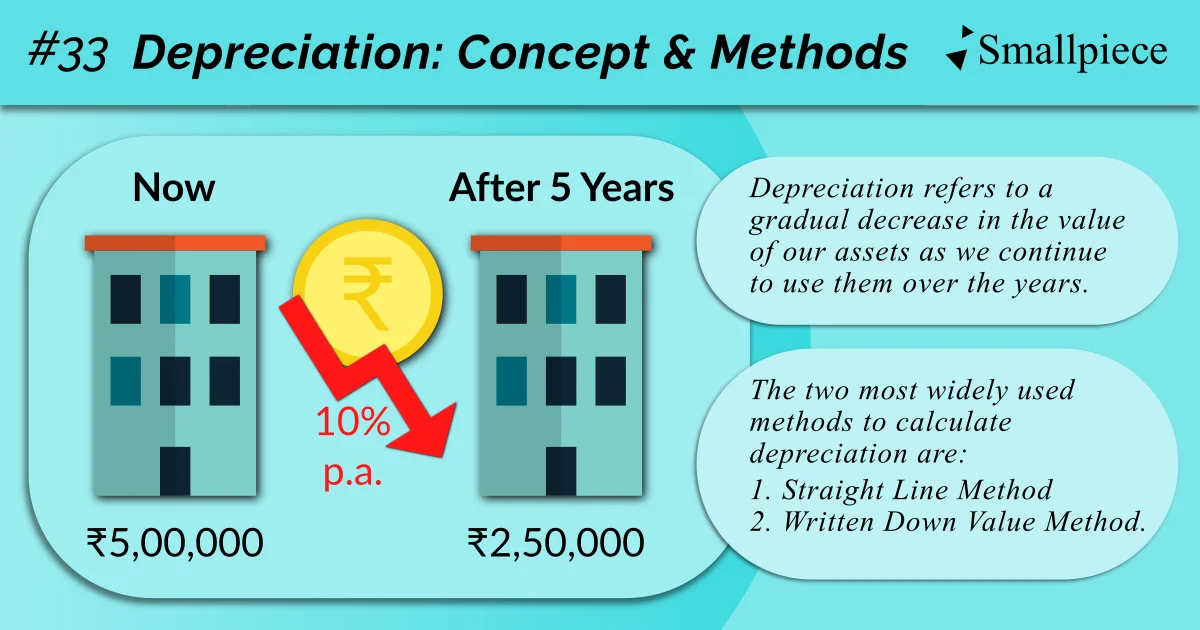

Today, we will pick up from where we left off in our last discussion: the concept of Depreciation, which refers to a gradual decrease in the value of our assets as we continue to use them over the years.

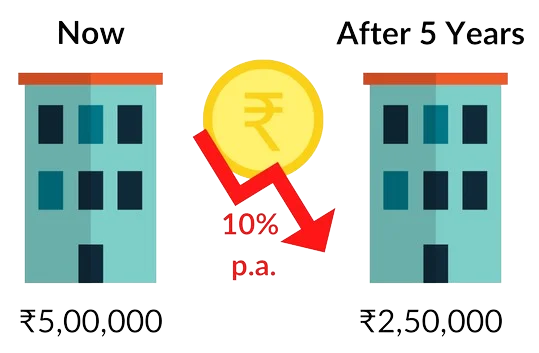

Suppose, we own a shop building from where we run our daily business operations. After 5 years of use, its value has reduced from, say, ₹5,00,000 to ₹2,50,000.

This reduction of ₹2,50,000 is what has been charged towards depreciation over the 5 years of use. Before we dive into the calculations, let us discuss what spawned this concept.

Putting Depreciation into Perspective:

It all emerges from the accrual concept we learnt earlier which states that receivables be recognised as assets and payables as liabilities. A very interesting application of this concept is the matching of expenses to incomes generated or benefits received in the particular accounting year.

This is also the basis for recording prepaid expenses as assets. In our last discussion, we saw the example of insurance premium where we had effectively matched a portion of the total premium to the 9 months’ worth of benefit of insurance coverage in the accounting year ended 31st March, 2023. The leftover portion will match the remaining 3 months in the next accounting year and till then, it will be treated as an asset.

This matching of expenses and incomes is technically referred to as the ‘Matching Concept’.

If we were to apply this same matching concept to payments that last longer than an annual insurance premium, for example, the purchase of a building to be used as shop premises, this results in depreciation.

The shop building will continue to be of use to us for, say, 10 years. So, it will be wrong of us to record its purchase cost as a single expense in a single accounting year. So, what do we do? We develop a mechanism to deduct some amount from the overall cost with each year it is in use. This amount is what we call ‘depreciation’.

The 2 methods of calculating depreciation:

While there are many methods to calculate depreciation, the two most widely used are:

- Straight Line Method

- Written Down Value Method

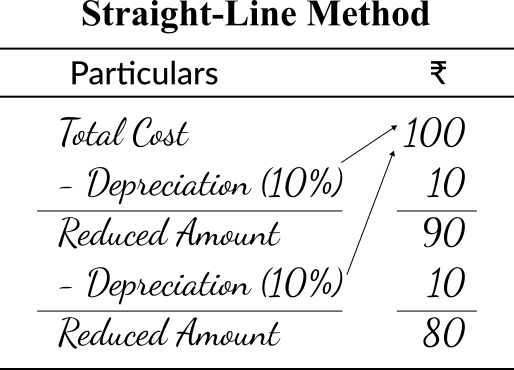

1. Straight Line Method:

Here, the amount to be deducted or ‘charged’ as depreciation remains fixed and is calculated as some % of the total cost incurred.

The example I used at the start: of our shop building depreciating to ₹2,50,000 from its total cost of ₹5,00,000 was something I based on the Fixed Cost method. To elaborate, I took 10% of the total cost to be charged as depreciation with each passing accounting year.

One other requirement of this method is a quantitative ‘Useful Life’; I had assumed it to be 10 years. And, it is on this assumed useful life, that I determined the 10% charge. Thus, the logic behind the Straight-Line Method (SLM) is simple: Allocate the total cost evenly across the useful life of the asset.

Being based on a single total cost figure, this method is also known as the ‘Fixed Cost Method’.

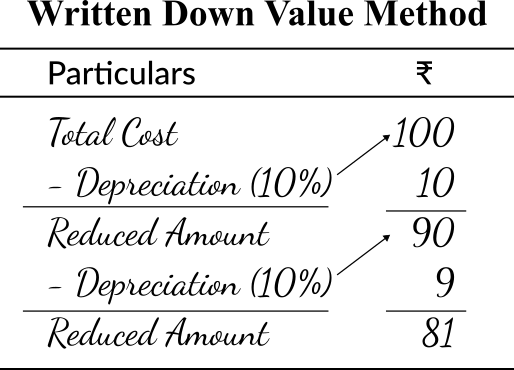

2. Written Down Value Method:

Under this method, though the percentage (%) remains fixed, the amount varies because the % is calculated on the residual value after charging depreciation for the previous year.

Accounting Treatment:

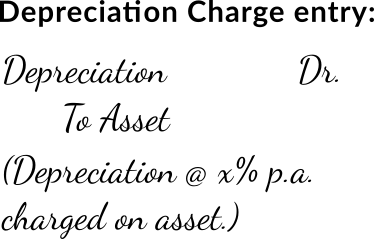

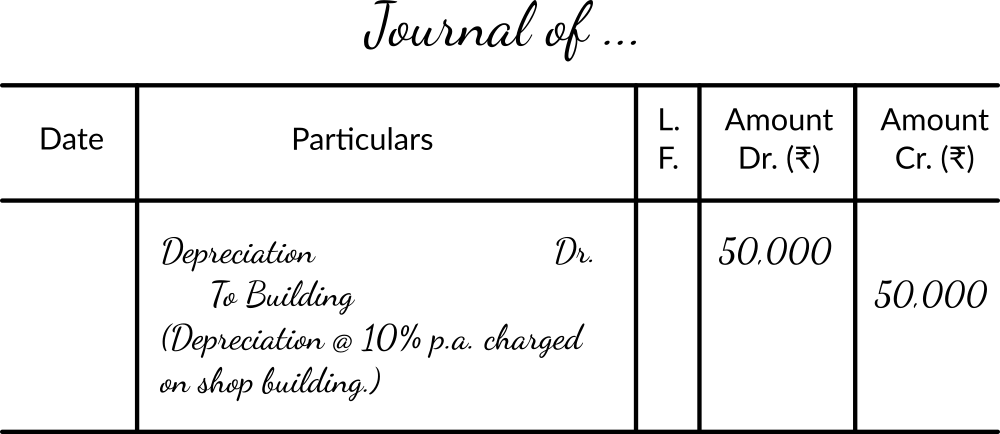

Since we have now understood the concept and the two most prevalent ways of calculating depreciation, we can move to the journal entry.

Depreciation is an expense and as such, will be tagged debit. Secondly, since it signifies a decrease in the value of an asset, the particular asset will be credited.

Now, in the context of our shop building example, the entry may be made as under:

Depreciation: A Non-Cash Expense

It is very important to clarify that depreciation does not indicate any cash payments, rather, it is simply a non-cash matching of a portion of the asset value to its use over the years. Hence, depreciation is classified as a non-cash expense.

With this fact, we put an end to today’s discussion on depreciation and also our long drawn-out theory on journal entries. Next will be a ‘Fully Practical’ and a ‘Try-it-Yourself’ post where I will be presenting a list of transactions to practice journal entries from. Till then, do revisit the previous to brush-up on the concepts we’ve learnt.

Academic Resource

Chapter 7, NCERT Accountancy, Class 11

https://ncert.nic.in/textbook/pdf/keac107.pdf

Leave a Reply