After comparatively long posts on special entries for goods and goods insurance, today, we’ll be discussing a small but very important accounting concept called the ‘Accrual Concept’.

Accrual Concept is what allows us to account for unpaid expenses and incomes receivable in future.

Before diving into this concept, let us first take a look at how accounting is done on cash basis, the simplest form of accounting that even non-accountants can employ.

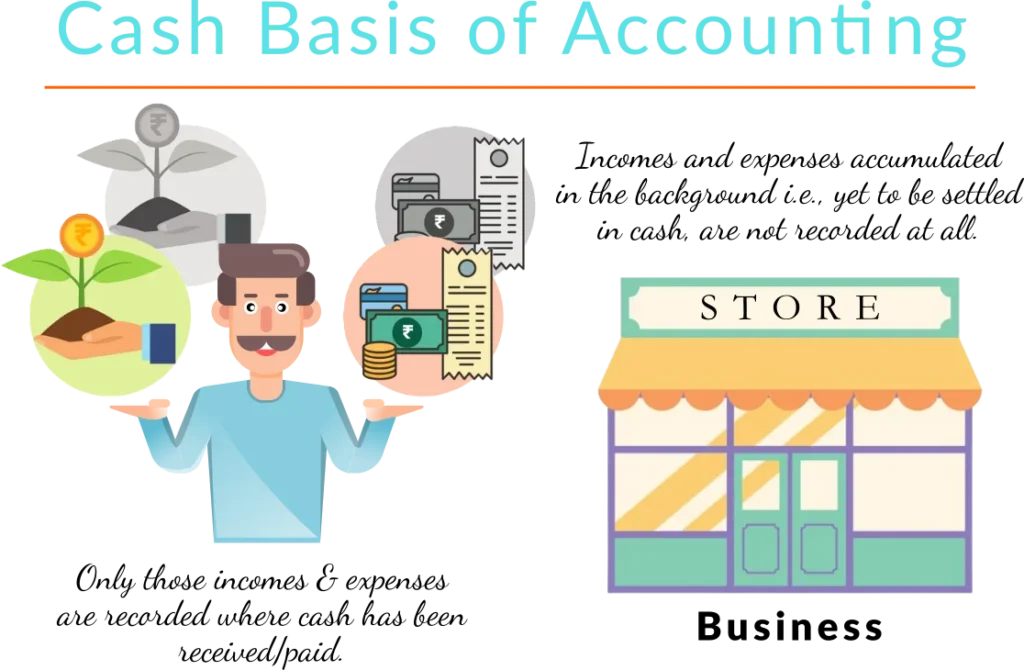

Accounting on Cash Basis:

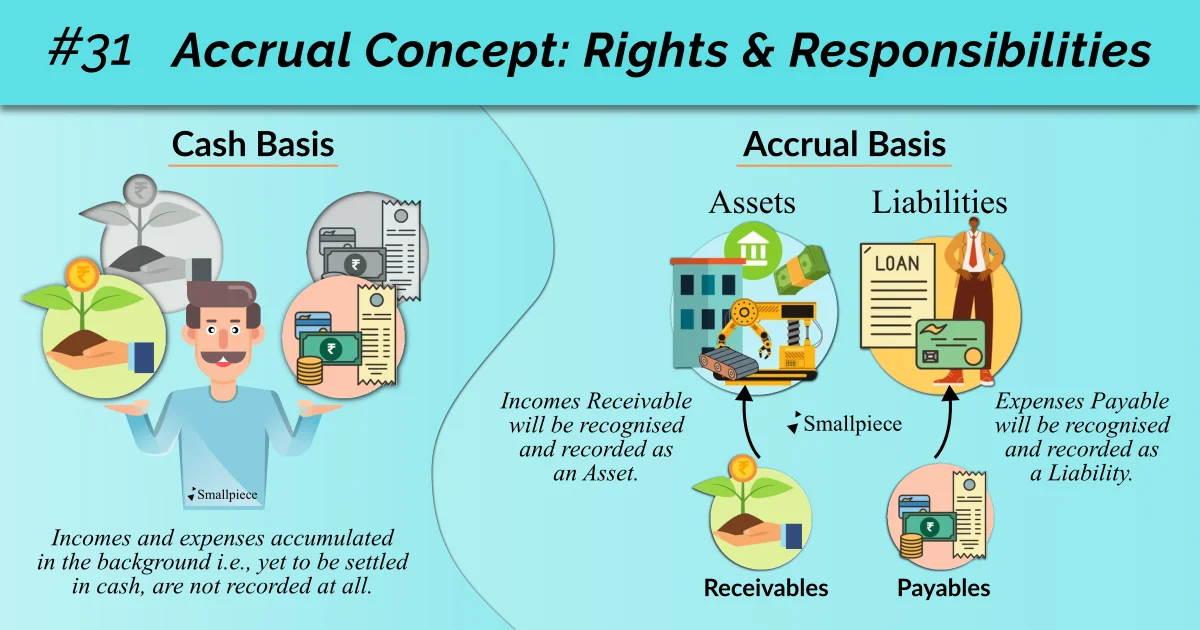

Cash Basis implies that we record a transaction only when it involves the receipt/payment of cash against a good/service.

Now, this may work for the street vendors and very small businesses but this basis fails to account for any sort of credit trade. In other words, the entries for debtor-creditor we learnt earlier cannot be made under the Cash Basis of Accounting.

This issue is resolved through the accrual concept to understand which, we must first understand the roots of what ‘accrual’ means.

Accrual – The Definition

The term accrual originates from the Latin word accrescere — meaning “to become larger.” Another meaning can be “to accumulate.”

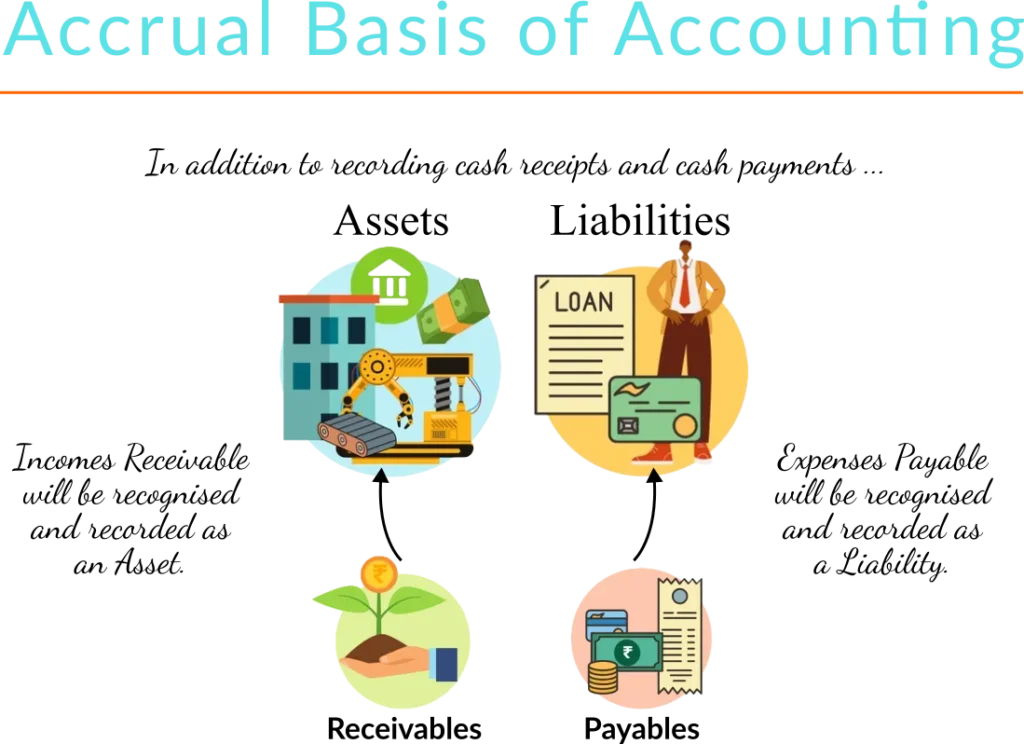

Accounting on Accrual Basis:

When you undertake a credit trade, you have either earned the right to receive an income in the future or, accepted the responsibility to make a payment in the future. This, in effect, is the same as accumulation of incomes and expenses in the background till the time they are realized i.e., cash is received/paid.

Under accounting on cash basis, neither of the accumulated income/expense is recorded in our books of accounts.

But done under the accrual basis, both of them can be recorded through terminologies like income receivable, expense payable, etc. This is what it means to undertake accounting on an accrual basis, which is more or less the norm in contemporary times.

In Summary

Accrual Concept states that expenses should be accounted for as and when they are incurred (i.e., when we have received the goods, services or benefit promised by the other party) and incomes / revenues should be accounted for as and when they are earned (i.e., when we have fulfilled our end of the deal), regardless of whether cash is actually paid / received or not.

References

1. “Accrual.” Vocabulary.com Dictionary, Vocabulary.com, https://www.vocabulary.com/dictionary/accrual. Accessed 03 Jun. 2025.

Leave a Reply