Loss by theft or loss by fire are very unfortunate and unpredictable events for any business. To protect them from such events, there are entities called ‘Insurance Companies’ in the market who offer Goods Insurance.

To understand what these companies do and what goods insurance is, we must know what the Insurance, the broader term, means.

Insurance is a form of financial shield that defends our business life from loss-incurring events such as loss by fire, theft, accident, etc. But, as true with all sorts of equipments, even this shield has some periodic maintenance costs.

If we were to take a look at a more specific definition,

Insurance is a promise of compensation for specific potential future losses in exchange for a periodic payment called premium.

~ Financial Education Booklet, Securities and Exchange Board of India (SEBI)

The entities who make this promise are called Insurance Companies or simply ‘insurer’ and the individuals / businesses to whom the promise is made are termed as the ‘insured’, who pay a periodic premium to the insurer to maintain the validity of the promise.

Since we are now familiar with the broader concept of Insurance, the meaning of Goods Insurance is almost self-explanatory. But if I were to spell it out, Goods Insurance is a form of insurance that protects our business from losses arising from any damage caused to (or loss of) goods at the warehouse or while they are in transit.

Now, imagine that in the case of theft and fire, the goods were covered by some insurance company. How would we make entries in that case?

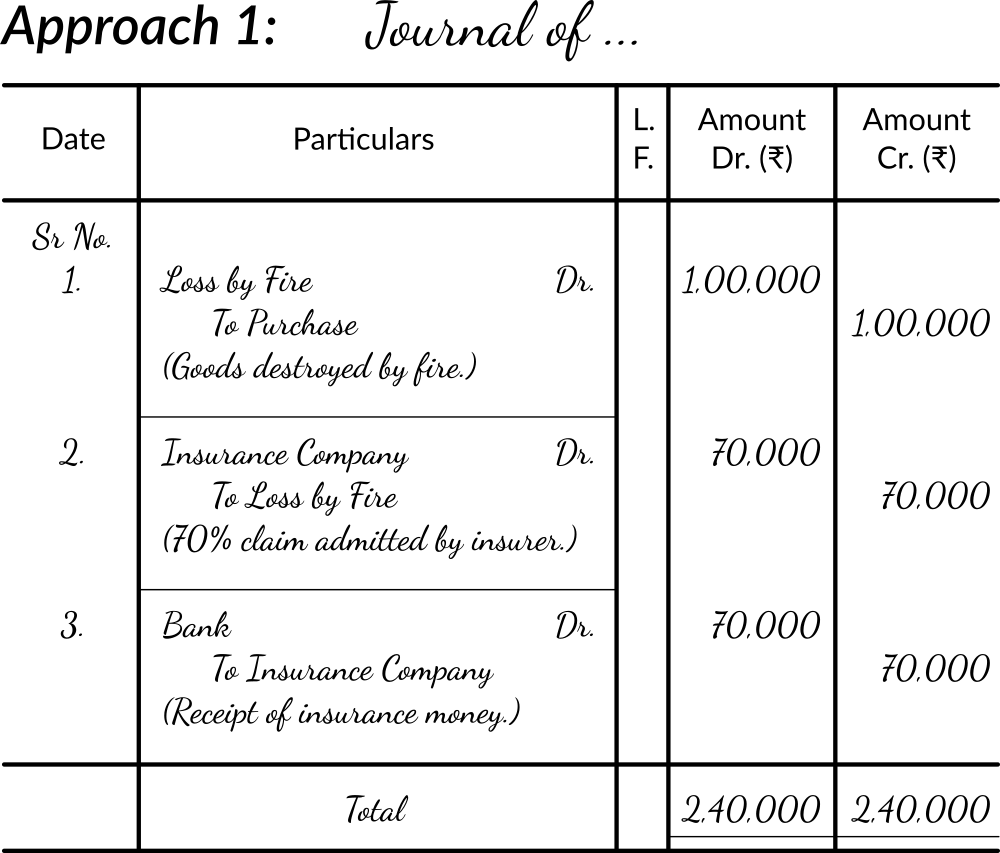

A general approach may be as follows:

First, of course, is to record the particular loss and call your insurer / insurance company to claim the promised compensation in such an event.

Then, company will send an agent to verify the extent of my loss to see if we told them the truth or we are just greedy human beings. Upon verification, the company may admit that I’ve spoken the truth, in which case, it can choose to:

(i) either cover our loss entirely (rarely happens because they are not just sitting upon huge piles of free cash) or,

(ii) cover a part say, 70% of the loss and leave us to bear the rest. (most likely, though the % figure may differ).

Lastly, there will be an entry to account for the receipt of the insurance money.

Note that there will be no separate entry for filing of an insurance claim because the lodging of claim by itself is a non-monetary transaction between the insurer and the insured and thus, a non-accounting transaction as per the Money Measurement Concept. Only after the insurer accepts x% of the claim can we attach an exact monetary value and make a journal entry, setting off the loss to the extent of the accepted claim. The legal fees paid, if any, is recorded separately and does not concern the insurer.

At least that’s how I would prefer to make entries when insurance is involved.

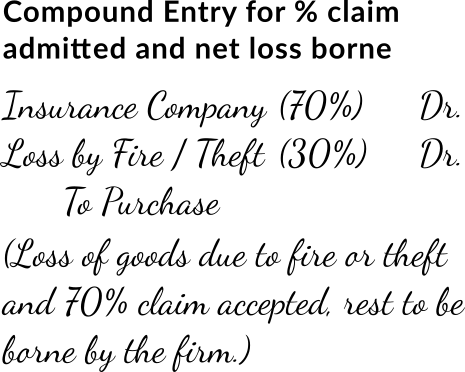

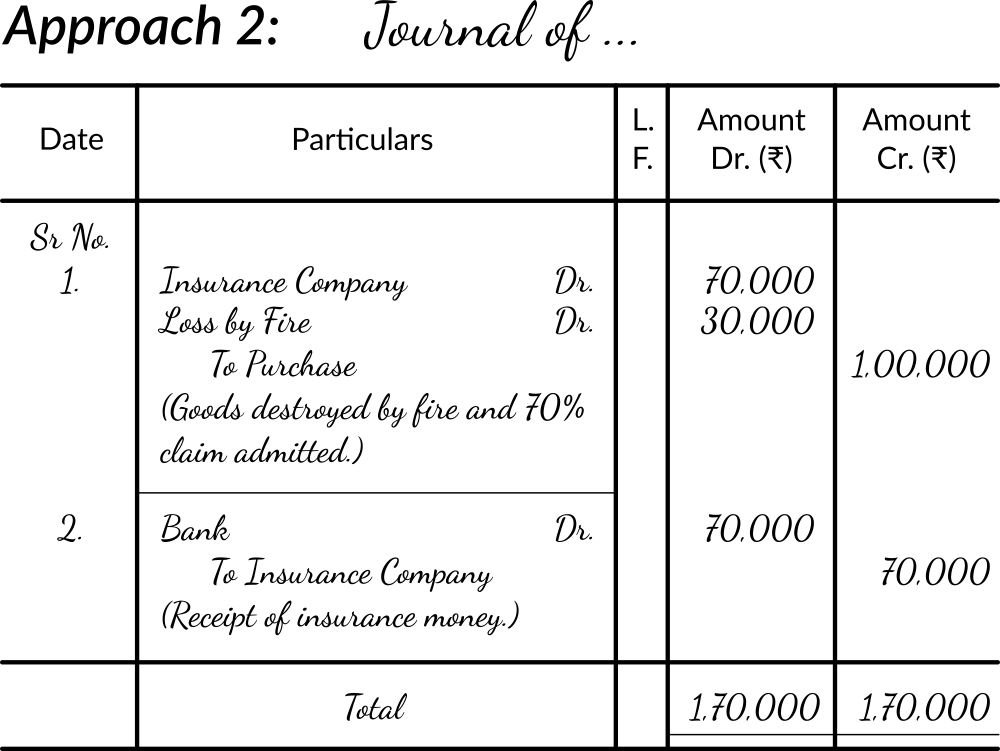

A different approach may be to avoid recording the loss at first and making a single compound entry after the insurer has admitted some percentage of the lodged claim.

Then, the entry for receipt of insurance money will follow.

This way, we’ll only have to make 2 entries instead of 3 in the above scenario.

Example

Suppose, just suppose, our warehouse catches fire and after the water / sand has worked its magic, we find that there has been a cumulative loss of about ₹1,00,000 in stored goods. Now, rather than recording this and simply crying about it, what I can do is call up my insurance firm, report this incident and file an insurance claim to shield my business from the impact of the said loss. After verification, my insurer has admitted, say, 70% of my claim which will be soon deposited to my bank account.

That was it for our discussion on Goods Insurance. We will meet with a new topic in the next snippet.

Reference

1. Definition of Insurance:

https://investor.sebi.gov.in/pdf/downloadable-documents/Financial%20Education%20Booklet%20-%20English.pdf

(Chapter 6, page 38)

Leave a Reply