Discount, put simply, is a deduction from the usual cost of something. In here, we’ll take a look at the journal entries for discount.

But before that, we must first discuss the two major types of discount:

- Trade Discount

- Cash Discount

To do so, we’ll make use of a difference between / comparison format.

Trade Discount V/s Cash Discount

Trade Discount

Cash Discount

1. Meaning

Discount on the retail price of goods which is given by one trader to another or by a wholesaler to a retailer.

Discount given to a customer or a debtor if he makes the payment before due date.

2. When is it allowed?

It is allowed on bulk purchases.

It is allowed when payment is made within the specified time period.

3. Why is it allowed?

To increase sales and help retailers generate profit when they sell at M.R.P.

To encourage quick payment.

4. Recording

It is only recorded in the invoice and not in the books of accounts.

It is recorded in the books of accounts.

5. Related to?

Purchase and sale of goods.

Payment.

To solidify our understanding of these discounts, let us take a simple example.

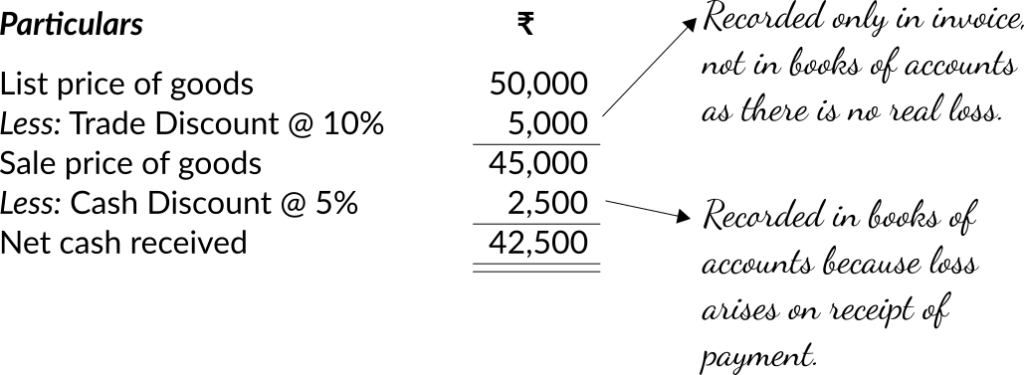

Suppose, we sell goods of list price ₹50,000 to a customer and allow him a 10% discount for bulk purchase. To encourage quick payment, we also offer him a further discount of 5% if he pays within 15 days. He fulfils this condition by making the payment on the 10th day after the sale.

The 10% discount offered at the time of sale is what we call Trade Discount. And the additional 5% discount that we allowed him as reward on his prompt payment is what we call Cash Discount.

After the discounts, the net amount of cash we received would be:

The trade discount of ₹ 5,000 will show up only in our invoice but when we make the journal entry, we would record the sale amount i.e., ₹ 45,000. On the contrary, cash discount will be mentioned in the journal entry for the receipt of cash.

Now, we’ll take a look at journal entries for transactions (both, cash and credit) where discount is involved.

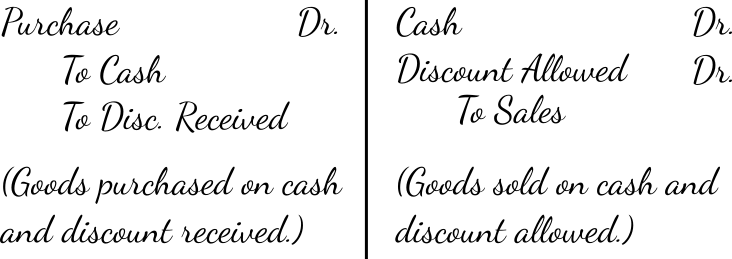

Case 1: Cash Transaction

The entry is similar to that for cash purchase and / or sale wherein, the buyer would see an increase in his stock of goods (an asset) which is debited under the name of ‘Purchase’ and a decrease in cash (also an asset) which is credited.

As for the seller, he would find his stock of goods decreasing which is credited under the name of ‘Sale’ and his cash would increase which is debited.

When discount, particularly Cash Discount is involved, the net amount of Purchase / Sale would remain the same and we would find a shortfall in the amount of Cash paid / received because that’s what discount is: a cut in the amount of cash we pay / receive.

As for the accounting treatment of discount, I would first like you to recall that all debits must equal all credits. For this very reason, we can say that the Discount item gets the same tag as the Cash item to equal things out with the net amount of purchase / sale.

And for more clarity, we use specific terms like ‘Discount Received’ when taking the lens of the buyer and ‘Discount Allowed’ when being the seller.

Another little technical detail is that Discount Allowed (Given) is classified as a loss and NOT an expense. But this doesn’t make much difference in accounts as both expenses and losses are treated the same.

Similarly, despite having the same treatment, Discount Received is classified as a gain and NOT an income.

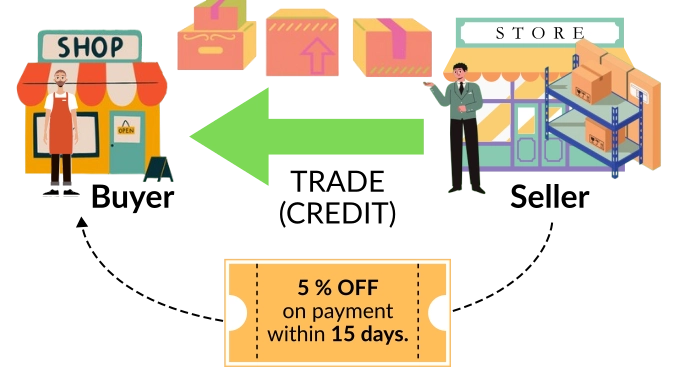

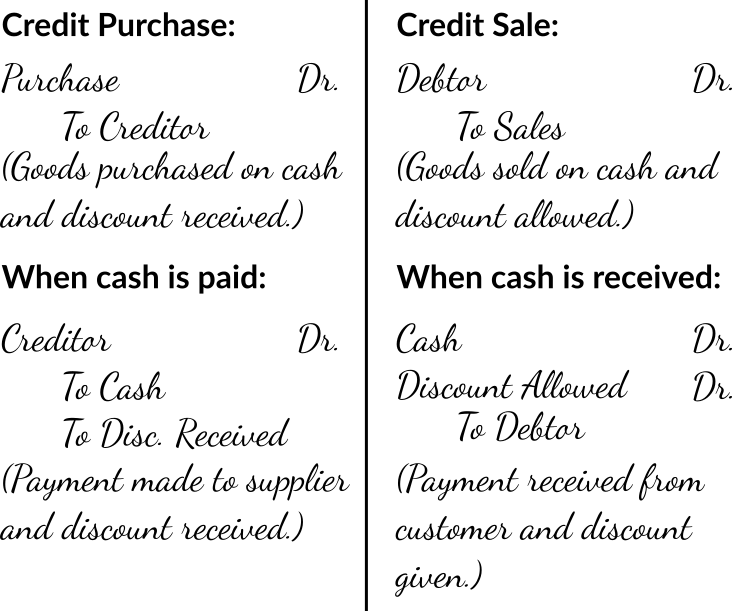

Case 2: Credit Transaction

Since a credit trade by definition means deferring (or, postponing) the payment, the entries for discount come at a later stage.

At first, we make the same entry as for a credit purchase and sale because Trade Discount (if, any) is recorded in the invoice and not as a separate item in our accounts.

Then, when the buyer makes the payment, we make the entries for discount. The only difference from cash transaction is that instead of the Purchase and Sale items, we mention the name of the creditor and the debtor.

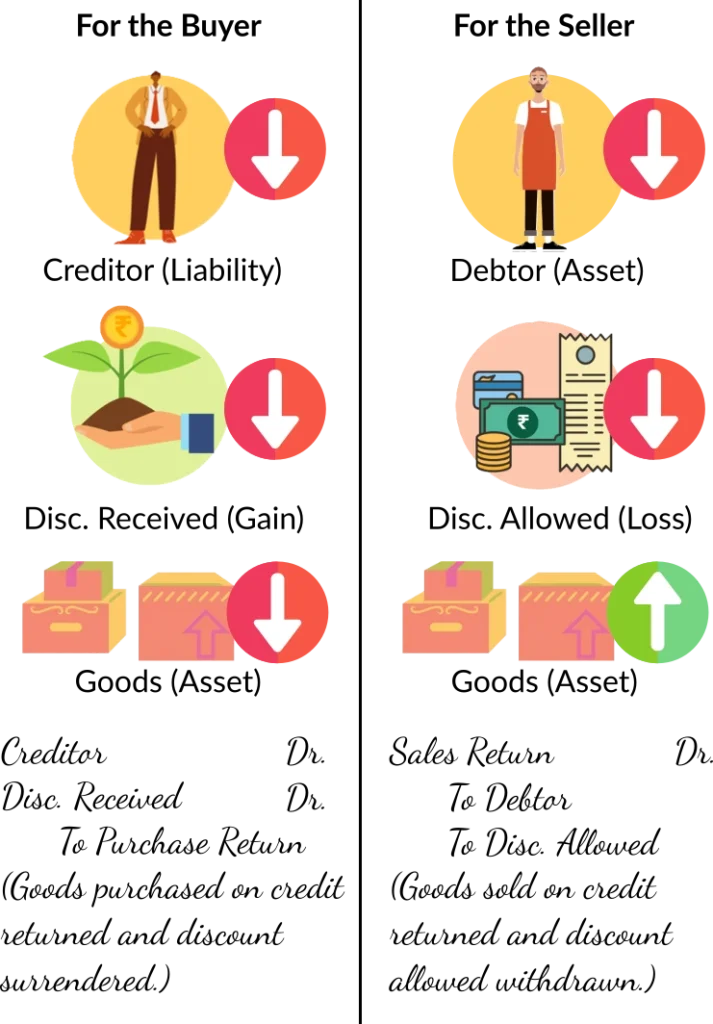

But what if some of the goods sold on creditor are returned? How do we account for them?

Return of Goods

Upon the return of goods sold on credit, instead of processing a refund, the seller can simply adjust the amount of returned goods against the buyer’s pending dues.

Thus, the buyer would find a decrease in his liability towards the creditor which is debited and a decrease in his stock of goods which is credited under the head of Purchase Return. But with the return of goods, he would also lose the discount that he received on the same (a gain), which is debited.

Flip the lens and we can say that the seller would find an increase in his stock of goods which is debited under the name of Sales Return and he would cancel the buyer’s dues to the extent of returned goods as well as the discount he allowed on the same, both of which are credited.

In all these entries for discount, there were more than two accounting items involved. Such entries are what we call Compound (Combined) Entries.

We have discussed how trade happens on cash or credit, how discounts are offered and the use of bill as a proof of transaction. Next, we’ll move on to a 3-part series on banking transactions that take place in a business.

Leave a Reply