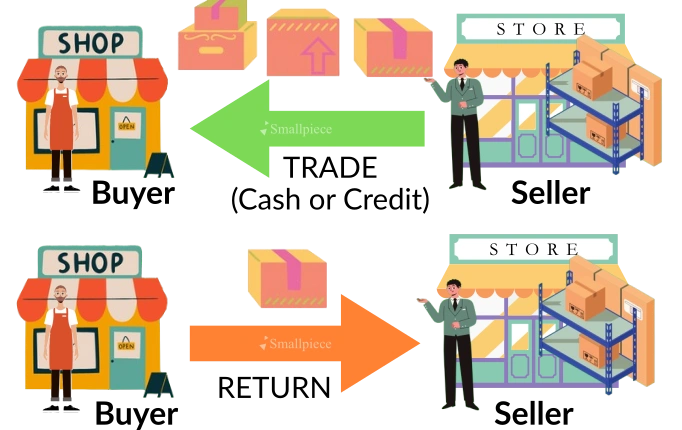

The Purchase or Sale of goods may happen on cash or on credit. But purchase return and sale return or simply, the return of goods generally follows a set sequence of actions or events.

Suppose that I purchased goods from a certain Mr. X and had made the payment in full. Now, I want to return some goods on account of defects. I cannot demand my money immediately; I will first have to send (or, bring) the defective goods to Mr. X. Then, he will verify my reason for return and only after doing so, he will process the refund.

But, if I hadn’t made the full payment and had some dues, Mr. X will simply deduct the value of the returned goods from my dues.

That is how a return of goods generally works.

Put simply…

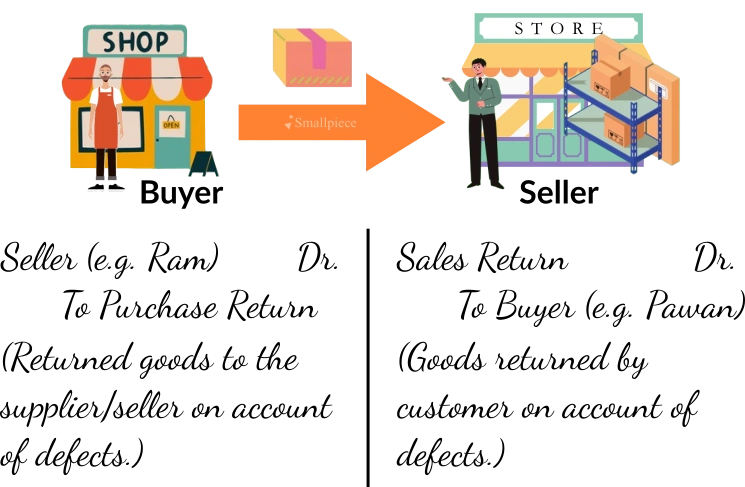

Purchase Return is an action of returning the purchased goods to the seller along with a note mentioning the reason for return, hoping to get a refund or replacement for the goods.

On the contrary, we may look at Sales Return as an event of getting back the goods sold earlier.

After verifying the reason for return, the seller may process a refund or adjust the amount of returned goods against the buyer/customer’s dues.

In order to make journal entries for purchase return and sale return, we’ll simply look at the events or transactions from the lens of either the buyer (who has returned the goods) or the seller (who has received the goods).

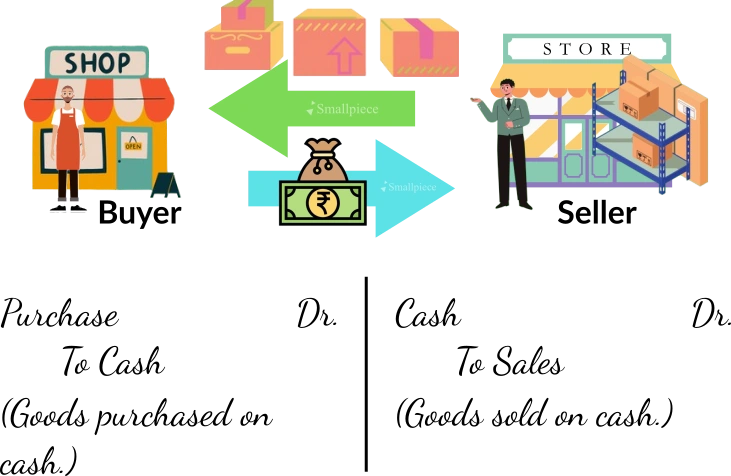

But before that, we must know whether the trade was done on cash or on credit.

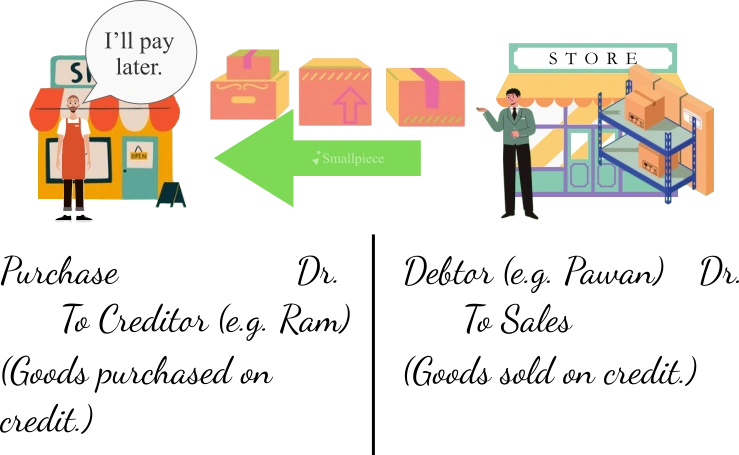

Case 1: Returns in case of Credit Trade.

1. Purchase & Sale on Credit

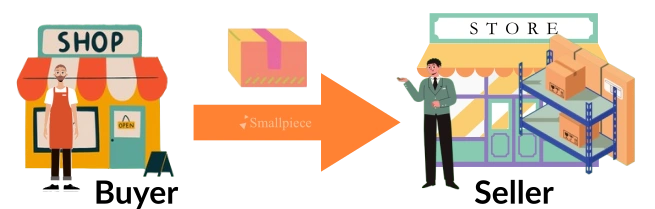

2. Return of Goods

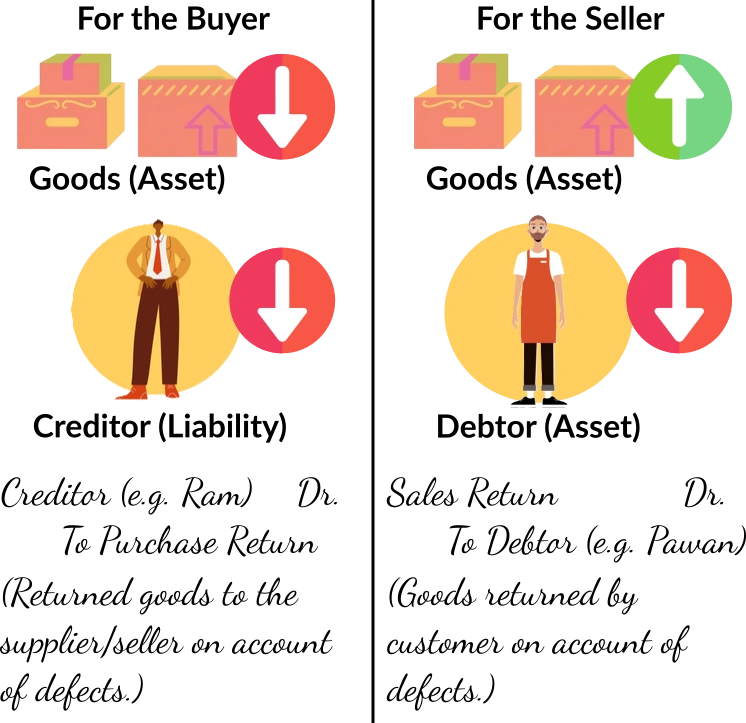

For the Buyer, his stock of goods (an asset) decreases to the extent of returned goods which is recorded using the term ‘Purchase Return’. Secondly, his liability toward creditors decreases.

On the other hand, for the seller, his stock of goods increases which will be recorded using the term ‘Sales Return’ and his receivables from debtors (an asset) decrease.

Case 2: Returns in case of cash trade.

1. Purchase & Sale on Cash

2. Return of Goods, Refund Pending

3. Refund Processed

Leave a Reply