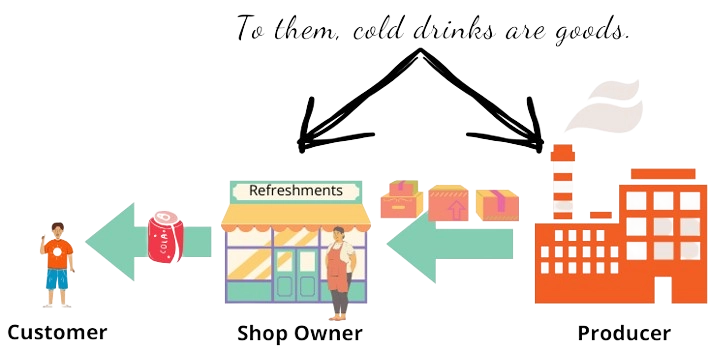

Goods are the commodities in which business deals.

For example, cold drinks, to you, maybe a simple refreshment but to the seller, they are his goods that he trades to make a profit.

As evident from our previous snippet, transactions related to goods are not simply recorded as Goods debited or credited. Rather, we make use of specific words as under:

1. Purchase: To record the purchase of goods. This receives the debit tag because stock, an asset, increases.

2. Sales: To record the sale of goods. Here, stock decreases and thus, it is tagged credit.

3. Purchase Return or Return Outward: To record return of purchased goods. Here, stock decreases and thus, tagged credit.

4. Sales Return or Return Inward: To record return of sold goods. Here, stock increases and thus, tagged debit.

5. Stock: To record the stock of goods left unsold at the end of the accounting period.

Types of Trade

As seen in the earlier snippet, trade is carried out on two bases: Cash and credit.

Cash Trade implies immediate receipt/payment of cash against goods.

Credit Trade implies delayed receipt/payment of cash against goods, on a pre-specified future date or within a pre-specified period (called, Credit period).

The journal entry for goods, be it purchase, sale, purchase return, sales return etc. is made in relation to whether the trade was on cash or on credit.

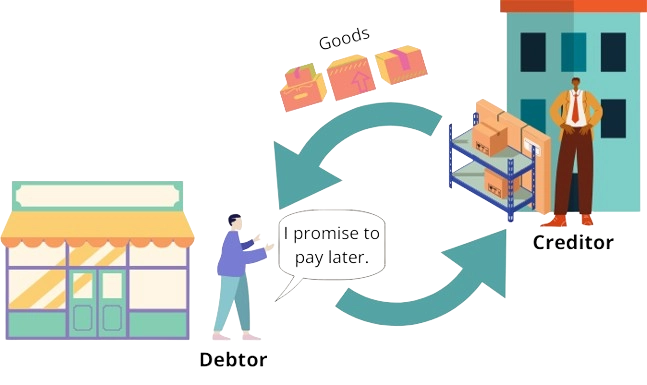

Debtor & Creditor

Debtor: A person or firm to whom goods have been sold on credit and payment is yet to be received.

It is expected that debtors, in future, will pay us i.e., they will put money into our pockets. Thus, debtors are an asset.

Creditor: A person or firm from whom goods have been purchased on credit and full payment is yet to be made.

We will have to pay the creditors in future i.e., they will take money out of our pockets. Thus, creditors are a liability.

With the understanding of these terms, we’ll move on to journal entries for simple purchase-sale transactions.

For NCERT Definition

Refer 1.5.19 Debtors and 1.5.20 Creditors from the following pdf –

https://ncert.nic.in/textbook/pdf/keac101.pdf

Leave a Reply