So far, we’ve only looked at two of the 4 types of transactions, Asset & Equity-Liability. Let us now address the other two, Income and Expense.

From our continued discussion on profit, it must be clear that any income that arises is entirely owed to the owners and denotes an increase in the value of Equity thus, tagged credit. Similarly, all expenses are met out of the owner’s funds and denote a decrease in Equity thus, tagged debit.

Put simply, the tags for an increase in income and expense, are credit and debit respectively owing to their effect on Equity. And, in line with Luca’s Uno Reverse, these tags will be reversed to denote a decrease in their value.

Overview of Debits & Credits

Natural Tags – A recall to Debits & Credits based on Cash Flow

To remember things more clearly, I used to bring in an additional element of Cash Flow. Simply put, all the 4 categories, based on the nature of their cashflow, work more with a single tag.

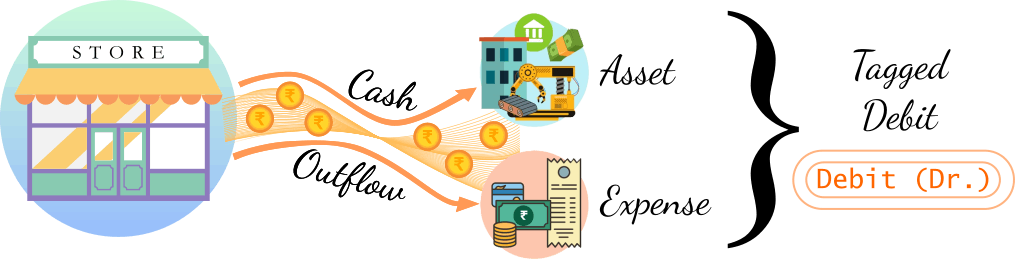

Assets and Expenses, as and when they arise (or, increase), result in Cash Outflow i.e., the movement of cash/funds out of the drawer or bank account of business and thus, their natural or usual tag is debit.

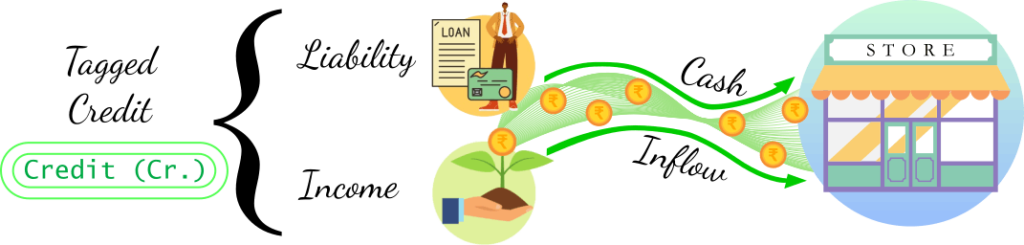

Whereas, Liabilities and Incomes, as and when they increase, result in Cash Inflow i.e., the movement of cash/funds into the drawer or bank account of the business and thus, their natural or usual tag is credit.

In situations where we find a reversal of Cash Flow, we will simple reverse the tags.

For e.g., Sale of an Asset and Receiving a Refund due to some reason, are transactions relating to assets and expenses. But both result in Cash Inflow, a total opposite. In this case, we will use the credit tag.

Similarly, Debt Repayments and Paying out Refunds, are transactions which relate to liabilities and incomes but indicate Cash Outflow which will be recorded through the debit tag.

That was all. It is finally the end of debits and credits; an excruciating topic indeed!

And now that we have had thorough discussions on the 4 types of transactions and recording them through the use of 2 tags, it is time we start applying our knowledge by making actual entries into journal or, the diary of business.

Reference

NCERT Class 11 Accountancy,

Topic 3.3.1 Rules of Debit and Credit, pg 9.

Leave a Reply