Precap

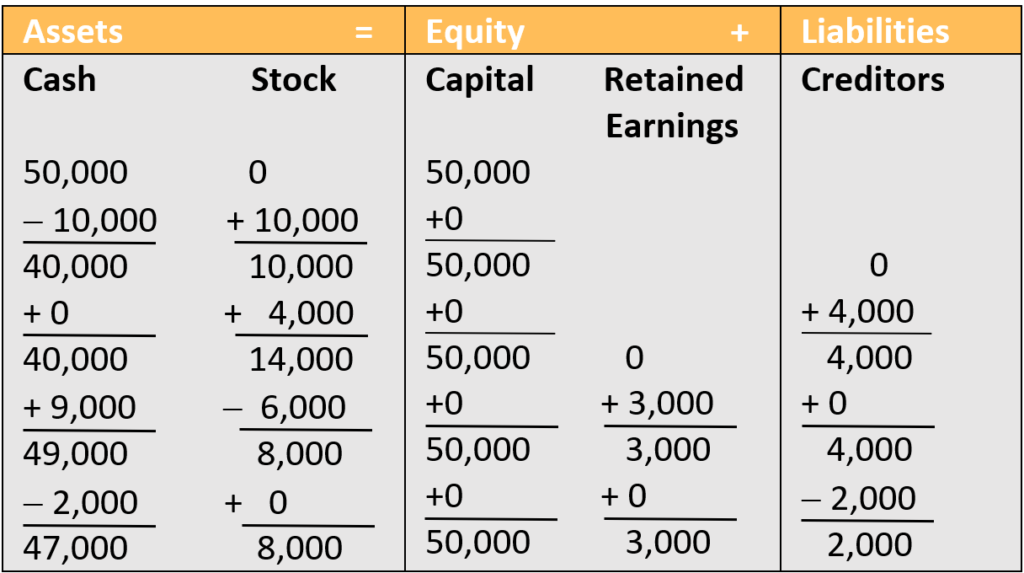

In order to test whether the Accounting Equation i.e., Asset = Equity + Liabilities holds true, we mapped 5 transactions:

- Capital worth ₹ 50,000 invested.

- Purchased wares (stock) worth ₹ 10,000.

- Purchased more stock worth ₹ 4,000 on credit.

- Sold wares worth ₹ 6,000 at ₹ 9,000.

- Repaid ₹ 2,000 to our supplier (creditor).

Now, we’ll finally undertake the test and try to observe the impact of each transaction on the two sides of accounting equation, viz, the Assets side and the Equity-Liabilities side.

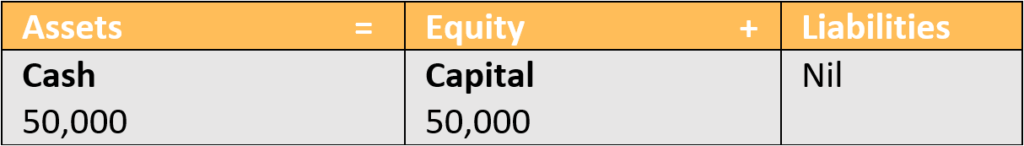

1. Invested Capital worth ₹50,000.

- Cash is something the business owns and uses to purchase stock which is then resold at profit. Thus cash, by way of helping us acquire different things, helps us generate more cash and hence, can be recognized as an asset.

- And capital is what we entrusted to the business and will appear under Owner’s Equity.

Both of these can be presented in the accounting equation as follows:

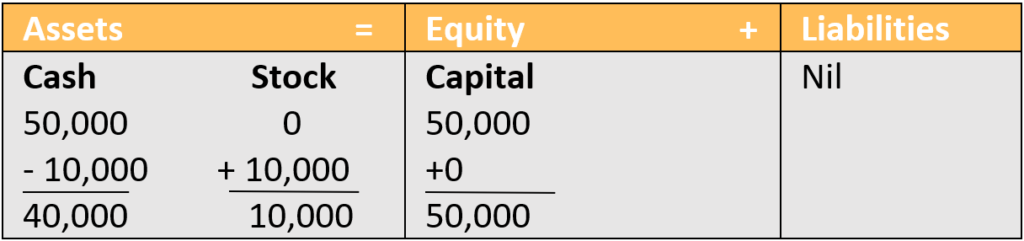

2. Purchased wares worth ₹10,000.

- Stock, when sold, will generate money for us. Hence, it is an asset.

- We had to use up some of our cash to purchase the stock i.e., cash decreases.

Here, only the assets side was impacted. But even so, the net effect on the equation was nil and the totals remains the same ₹50,000.

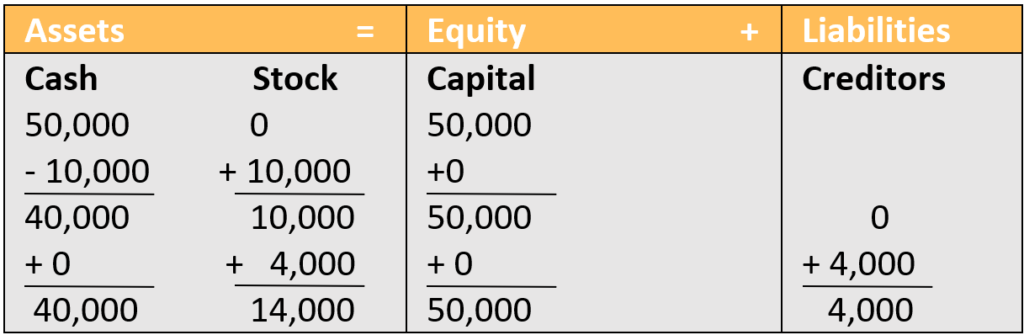

3. Purchased more stock worth ₹4,000 on credit.

- Our stock increased by ₹ 4,000.

- Credit purchases imply a promise and a responsibility of making payments to the supplier/creditor in future. And, as we learnt, any sort of responsibilities towards third-parties are recorded under the head of Liabilities.

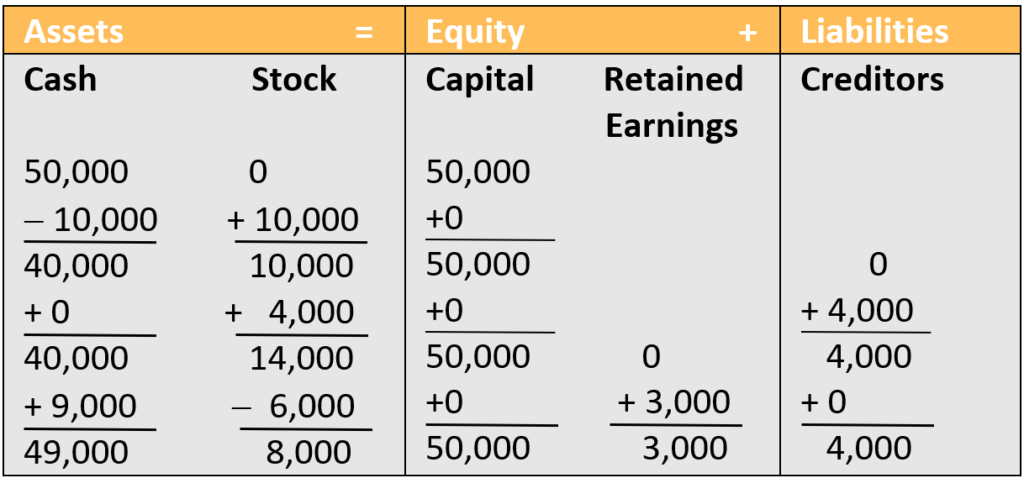

4. Sold wares worth ₹6,000 at ₹9,000.

In this transaction, we have not two but three effects:

- Increase in cash worth ₹ 9,000.

- Decrease in stock worth ₹ 6,000

- Profit i.e., the excess amount made on sale (i.e., 9,000 – 6,000 =) ₹ 3,000. It will be recorded under the head of Equity as ‘Retained Earnings’.

Retained Earnings: A Quick Reminder

We discussed that it is good practice to assume that profits when they arise will remain in the business to be used as an additional source of funds, over and above the initial capital. ‘Retained Earnings’ is the formal term used for profits retained / reinvested into the business.

Should the owner desire, he can later withdraw a portion of the same for his personal use (called, Drawings).

5. Repaid ₹2,000 to our supplier.

- Decrease in Cash.

- Decrease in Creditors.

At Last, we sum up all the items and get:

Assets (₹55,000) = Equity (₹53,000) + Liabilities (₹2,000)

Thus, the accounting equation holds true for all the transactions.

We can also conclude that for each and every transaction, there was an equal impact on both the Assets side and the Equity-Liabilities side, which is also what the Dual Aspect Concept says, “Every transaction has a two-fold impact on business”.

The impact on Assets of a business is recorded through the Debit tag and that on Equity-Liabilities side through the Credit tag.

But, there is a little something we’ve missed out on.

Unlike us, Luca lived in the 15-16th century and people in historic times had issues they had yet to overcome. One such problem/issue severely affected the way in which we tag i.e., debit or credit the above transactions in our books of accounts: Negative Numbers.

Reference

NCERT Topic 3.2 Accounting Equation –

https://ncert.nic.in/ncerts/l/keac103.pdf

Leave a Reply