Here, we’ll set the premises to test the accounting equation.

Imagine that we start a clothing business and now, let’s map some transactions likely to occur in this business.

“What is the first thing that any business needs?”

Some cash and that too, straight from our pockets (called, Capital)

This is because at its inception, business is an entity separate from the owner and has no money of its own. Suppose, we invested ₹50,000.

What do we do with this cash? We stock up on some wares that can be put up on sale. Say, we purchased wares worth ₹10,000 from a manufacturer. These wares, until sold, are called Stock.

Now, we look around us and find that… the business we have entered into is very competitive. There are a ton of sellers and the stock we have won’t last us for very long; we need to purchase at least ₹4,000 worth more. But we already have ₹10,000 i.e., one-fifth of our capital, locked up in Stock. If we lock more and don’t make any sale, we’ll be in trouble.

“So, what to do?”

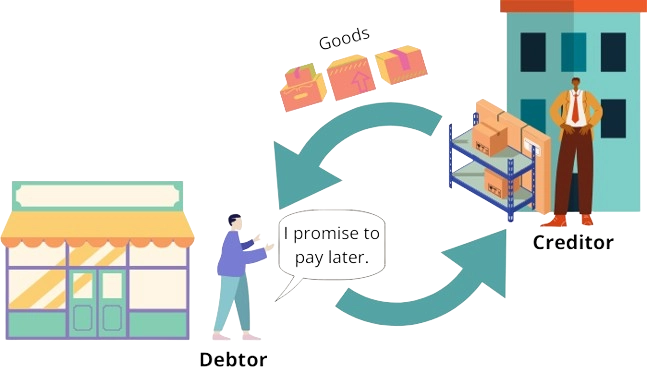

We go ahead with the additional purchase but don’t pay the money upfront rather, we promise our supplier that we’ll pay him later and ask him to entrust/lend the goods to us at present.

This, in business language, is called credit trade i.e., purchase & sale of goods at present but paying/receiving the money in future. The one lending the goods is called Creditor and the one in debt is called debtor. Accounting, through its Accrual Concept, allows us to record not only cash transactions but also those transactions where money is yet to be paid/received.

(Fast Forward…)

With all our planning and hard work, we have made good sales; ₹6,000 worth of stock sold at ₹9,000 (i.e., a profit of ₹3,000. Nice!) and are now at a stable position in the market.

In the midst of our joy, we suddenly remember our supplier: the one who made this all possible. Towards our promise, we decide to repay half of what we owe to him i.e., ₹2,000.

And, that is where we must put an end to our imagination; on a happy note. Also, we’ve thought of enough transactions to suffice for our test.

An overview of the 5 transactions we mapped is as follows:

- Capital worth ₹ 50,000 invested.

- Purchased wares (stock) worth ₹ 10,000.

- Purchased more stock worth ₹ 4,000 on credit.

- Sold wares worth ₹ 6,000 at ₹ 9,000.

- Repaid ₹ 2,000 to our supplier (creditor).

Next, we’ll find out whether the accounting equation i.e., Assets = Equity + Liabilities holds true in the premises / transactions we’ve set.

Reference / Further Reading

1. Textual definitions for the following:

Capital (1.5.5) , Stock (1.5.18) , Debtor (1.5.19) and Creditor (1.5.20)

https://ncert.nic.in/textbook/pdf/keac101.pdf

2. Basis of Accounting (Topic 2.4)

https://ncert.nic.in/textbook/pdf/keac102.pdf

Leave a Reply