Let us revisit the concept of a business transaction but, from a different perspective.

Any transaction or an exchange, by its very definition, involves two activities i.e., a Give & a Take.

For e.g., on sale of a product, I not only take money from my customer but also give him the requested goods.

Similarly, each transaction, be it buy or sell, is looked at from two different viewpoints, both of which are recorded in the journal.

And, the idea that every transaction has a dual aspect or two-fold impact on business is what we refer to as the Dual Aspect Concept.

To record both the aspects, we make use of two labels / tags: Debit and Credit.

To understand how these tags are used, let us recall the 4 basic types of transactions and their similarities.

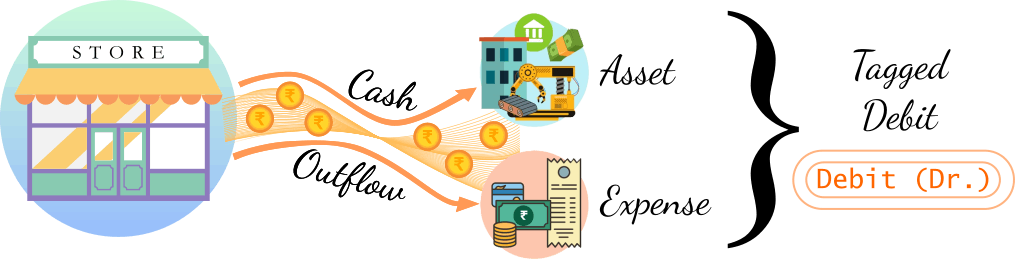

Asset and Expense, both indicate Cash Outflow and are tagged Debit.

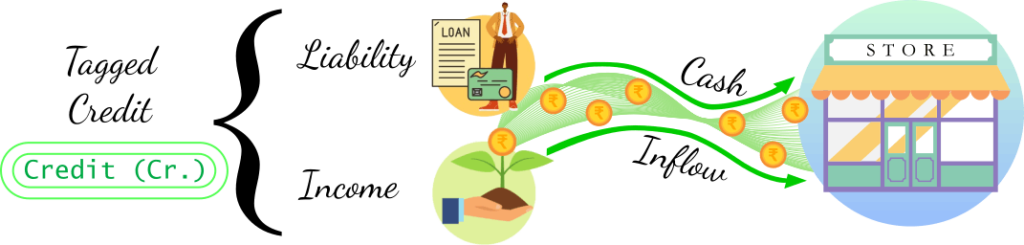

Liability and Income, indicate Cash Inflow and are tagged Credit.

In situations like Sale of Asset, Purchase Return on account of defective goods, Sales Return and Debt Repayments, which indicate a total opposite cash flow than normal, the tags will be reversed.

This was a simple overview of how the Debit & Credit tags are distributed among the 4 types of transactions, based on their Cash Flow.

Even though it is possible to move on with our current understanding, we’ll explore further and dive deeper into the history and use of these tags, based on not cashflow but the Accounting Equation.

Reference

NCERT Class 11 Accountancy, Topic 2.2.6 Dual Aspect Concept –

https://ncert.nic.in/textbook/pdf/keac102.pdf

Leave a Reply