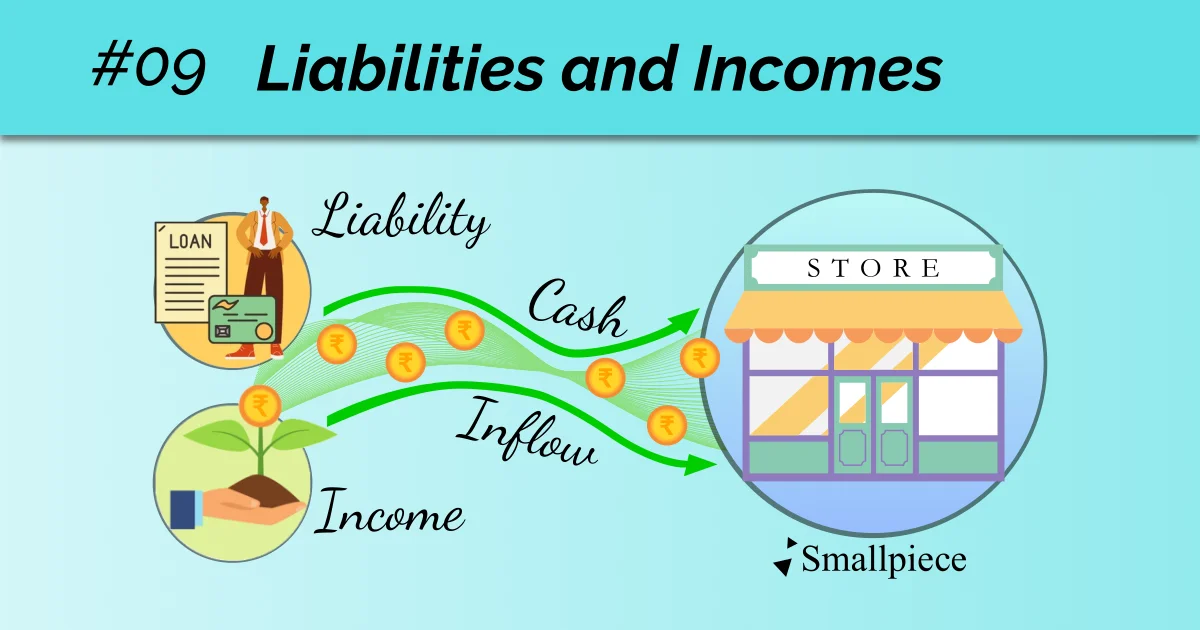

The similarity between liabilities and incomes is that opposite to assets and expenses, they result in Cash Inflow: the movement of cash/funds into the drawer or bank account of the business. This may be by way of profits, loans from banks, etc.

The difference is the nature of the item concerned.

If I receive a sum of money as a loan, I will record it as a Liability.

This is because loans have a repayment obligation (responsibility) attached to them.

However, if I receive money against sale of a product, it will go as an income in my books.

An interesting case, here, is that of Profit which acts as both an Income and a Source of Funds.

Profit

Profit, by itself, is an income which a businessman can rightly take home. But, if you recall, in one of the earlier snippets, I said that profit also appears in the Balance Sheet under the Sources of Funds (Liabilities) column.

So, Profit is our personal income but then it is also a source of funds for our business. How do we link these two aspects of profit?

Normally, profits are not withdrawn in their entirety by any businessman. A good businessman always reinvests a part of the profit into his business and this reinvested portion appears as a source of funds, alongside the initial Capital invested by the owner.

In accounting, it is good practice to assume that our profit, after fulfilling interest and tax obligations, will be entirely reinvested or, retained into the business. If the owner so desires, he can later withdraw a part and take it to his home (called Drawings in technical language).

Leave a Reply