An asset, as discussed earlier, is a use of funds with an aim to generate money. An expense, too, is such a use of funds.

If we were to understand this a bit technically, the movement of cash/funds out of the drawer or bank account of business is what we call ‘Cash Outflow’.

Both Assets and Expenses result in this Cash Outflow.

That was the similarity.

Now, what’s the difference between the two?

The Expiry Date.

Much like products, uses of funds have their own expiry date. For e.g., your mobile recharge expires in 1 or 2 months based on your recharge plan.

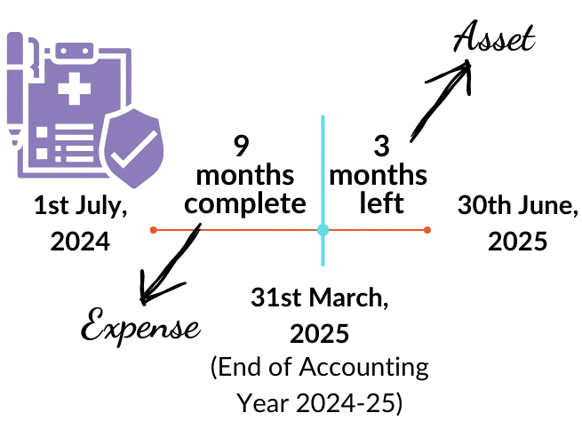

To separate Uses of Funds into assets and liabilities, their Expiry Date is compared with the end date of the accounting year (i.e., with 31st March).

Those uses of funds (in part or, full) which expire on/before 31st March i.e., end of the accounting year, are called expenses.

Those uses of funds (in part or, full) which do not expire or, remain valid even after 31st March i.e., end of the accounting year, are called assets.

For e.g., insurance premium of ₹1,200 is paid on 1st July 2024 for one year.

The accounting year started from 1st April, 2024 and will end on 31st March, 2025. But our premium is till 30th July of the same year. Thus, 9 out of 12 months have expired and 3 out of the same will stay valid even after 31st March.

In line with the above definitions, the premium for 9 months (1200*9/12) = ₹ 900 will be treated as an expense in the and the same for the remaining 3 months (1200*3/12) = ₹ 300 will be shown as an asset.

Now that we’ve understood assets and expenses, let us move further to understand liabilities and incomes: the similarity and the difference between the two.

Leave a Reply