It all begins with a simple realisation; that it is not possible to estimate the life of a business (i.e., how long a business will carry on). Thus, for accounting purposes, an assumption is made that a business will continue for a long period of time maybe till eternity, who knows? And this very assumption, is what we call the Going Concern Concept.

But it also led to a problem:

If my business will go on for a long time, when should I calculate profits? After all, the true profit of any business can be found only when it shuts down i.e., at a time when we have the exact figures of money spent on and earned from the business over the years.

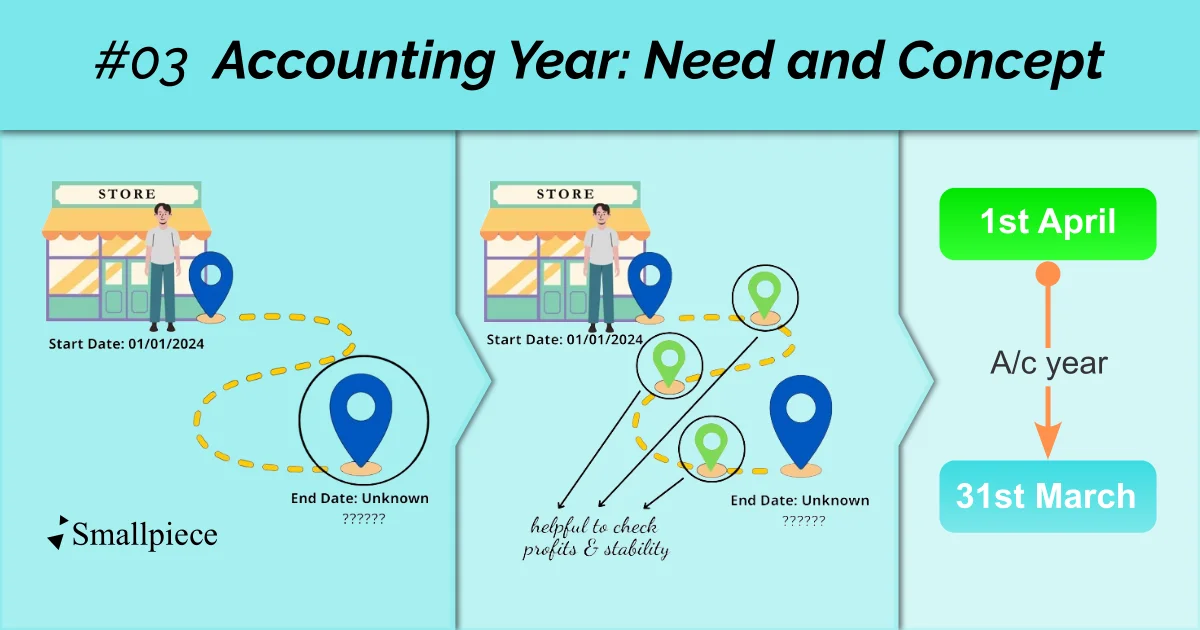

To solve this problem, accounting transactions of a business were grouped into equal time periods, referred to as accounting periods, each starting from 1st April to 31st March in India.

The idea of breaking down the life of a business into equal periods, each spanning a year, for accounting purposes came to be known as the Accounting Period Concept or, the Periodicity Concept.

It is worthwhile to note that different countries accept different 12-month periods as their accounting year. For e.g.,

USA – Oct. 1 to Sept. 30

Australia – 1 July to 30 June.

Many companies, till this day, use the normal calendar year (January to December) as their accounting year. But, for the sake of consistency, we will use 1st April to 31st March as our accounting year/period going forward.

Reference

Topics 2.2.3 and 2.2.4 (NCERT)

https://ncert.nic.in/textbook/pdf/keac102.pdf

Leave a Reply