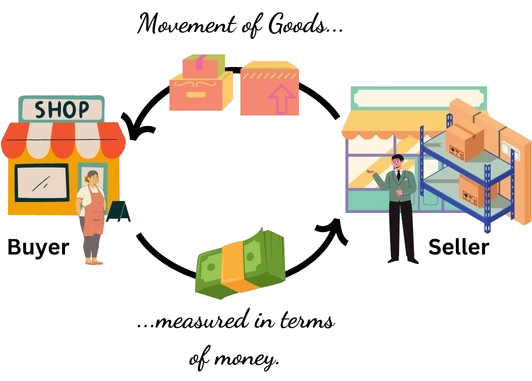

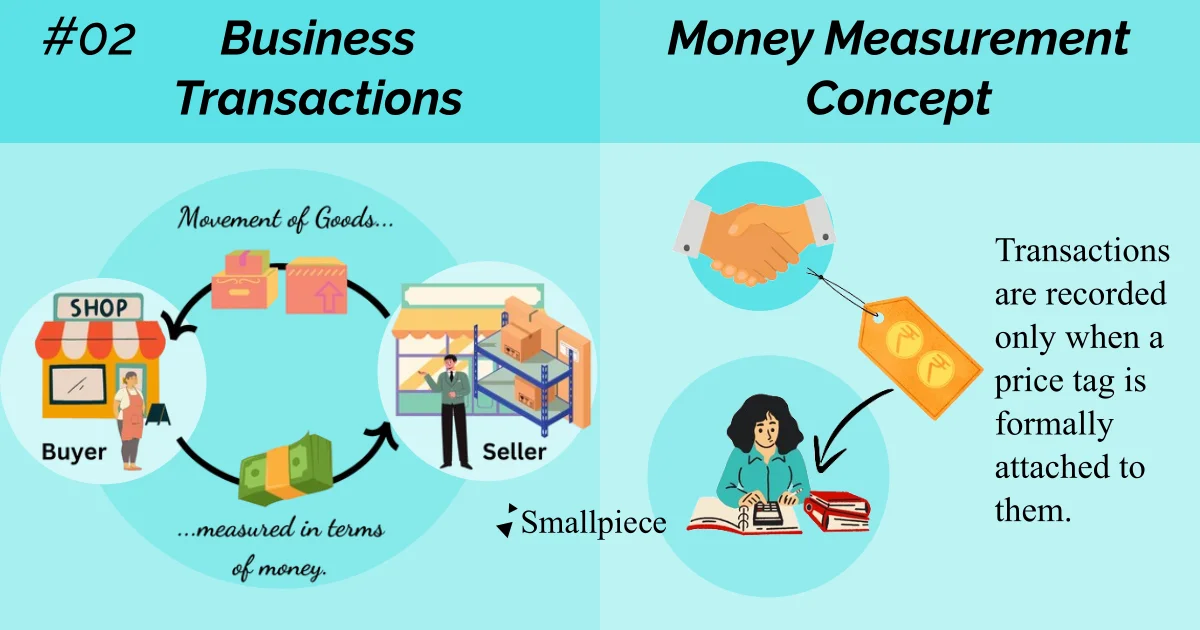

A business transaction is an exchange (movement) of goods or services between two or more parties. The goods or services must have a monetary value i.e., a price tag, attached to them.

An alternative definition is that a business transaction is a completed agreement between two or more parties indulging in an exchange which we will discuss shortly.

For now, let’s focus our attention to the first one.

If it is compulsory to have a monetary value or a price tag, this also implies that transactions which cannot be measured in terms of money are not qualified to be called business transactions. Such transactions, in technical jargon, are called non-economic transactions.

A question then arises: When exactly is a price tag or monetary value attached to a transaction, qualifying it as a business transaction?

This brings us to the explanation of the second definition.

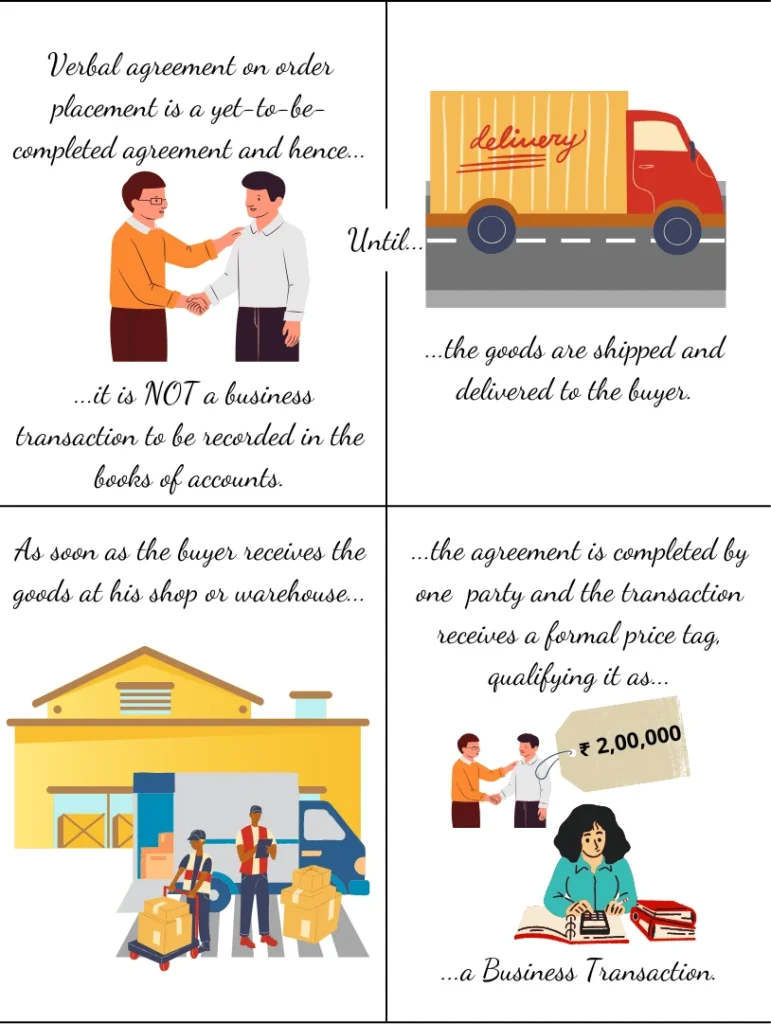

Suppose, a buyer and seller enter into a verbal agreement for purchase of goods. But this remains a yet-to-be-completed agreement till say, the seller ships the goods or, the buyer makes the payment. Hence, a verbal agreement or any order placement, by itself, is not treated as a business transaction and is consequently, a non-accounting transaction.

But, as soon as either party fulfills its end of the deal, the agreement is said to be completed by one party at least and a price tag is formally attached to the transaction qualifying it to be called a business transaction and consequently, an accounting transaction.

This notion that only monetary transactions i.e., only those transactions that can be measured in money terms should be recorded and non-monetary transactions should be ignored is what we call the Money Measurement Concept in accounting.

Now that we have understood when to recognise and record a business transaction, I put before you another question:

Why do we check the profits and stability of our business on a yearly/annual basis? Wouldn’t it be better to do so every 6 months, 3 months or better yet, every month?

Let us try to answer this next; Accounting Year: Need & Concept

Reference

Topic 2.2.2 Money Measurement Concept (NCERT)

https://ncert.nic.in/textbook/pdf/keac102.pdf

Leave a Reply