Now that you must have gotten hang of the 4 types of transactions and the 2 tags given to them, we can finally record a transaction and make our entry into practical accounting.

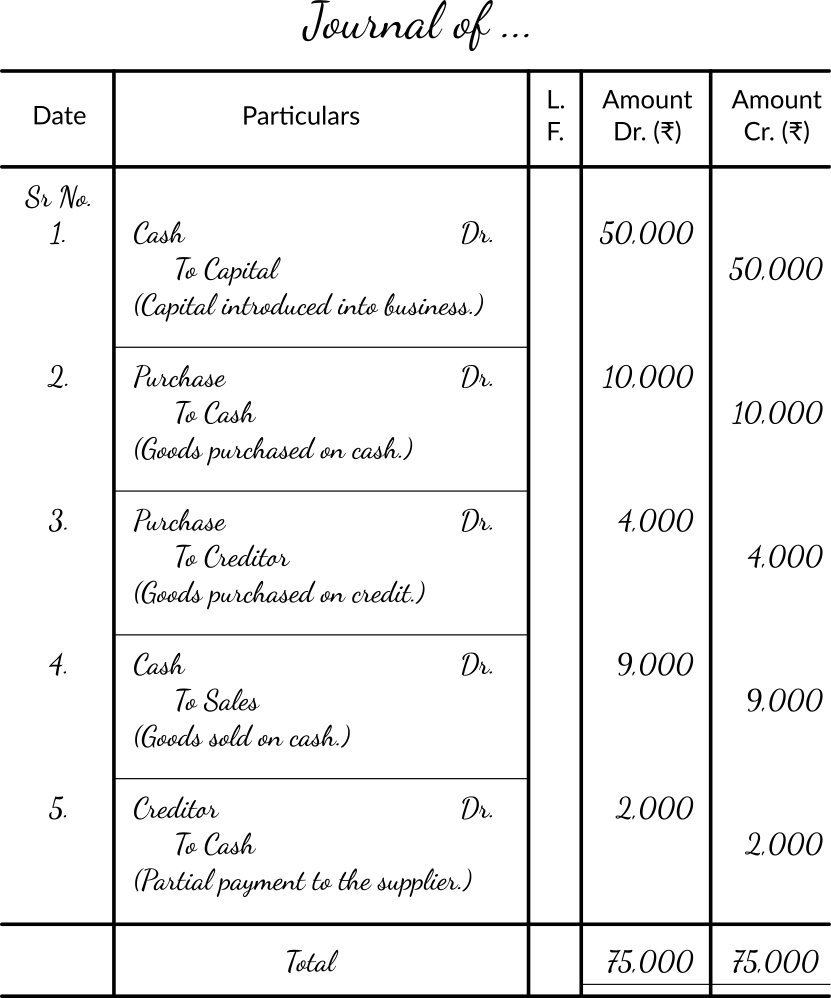

To illustrate how transactions are recorded, I would like to bring back the transactions we mapped earlier in our example of a clothing business.

- Invested capital worth ₹50,000.

- Purchased wares worth ₹10,000.

- Purchased more stock worth ₹4,000 on credit.

- Sold wares worth ₹6,000 at ₹9,000.

- Repaid ₹2,000 to our supplier.

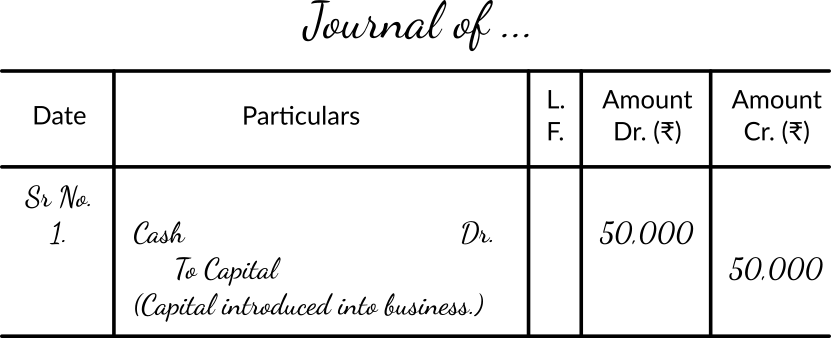

Let us start with the first one: Invested capital worth ₹50,000.

If you recall, we learnt that every transaction has at least two effects. The ones that arise out of this transaction are:

- ₹ 50,000 cash received by the business.

- The same, lent by the owner.

Since cash helps us purchase stock and other things which help generate profit, cash too is an asset. An increase in cash (an asset) is tagged debit.

Secondly, the sum of ₹ 50,000 was sourced by way of Owner’s Capital. And, increase in Capital (Equity) is tagged credit. These two effects are written or entered into the journal as follows:

In case you were wondering why we don’t give Cr. to the credit effect, it is simply because there are chances of making an error while analysing our accounts in future. Thus, the credit effect is distinguished by an indent and ‘To’ as a prefix.

Now, let us move on with the other transactions.

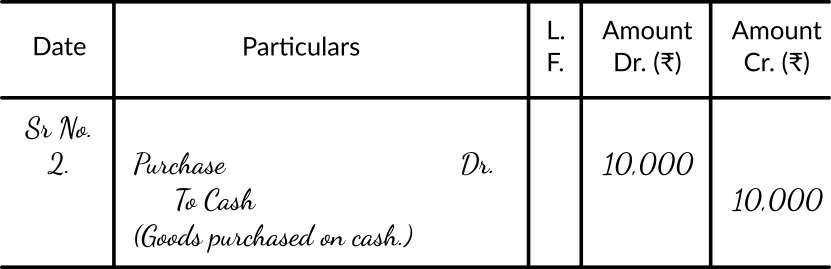

Purchased wares worth ₹10,000.

The two effects, here, are:

- ₹ 10,000 worth of goods (an asset) received by the business. An increase in asset is debited but an important point to note is that transactions relating to goods are recorded using specific words like Purchase, Sales, Purchase Return and Sales Return to properly distinguish expenses and incomes.

- A decrease of ₹ 10,000 in Cash (an asset).

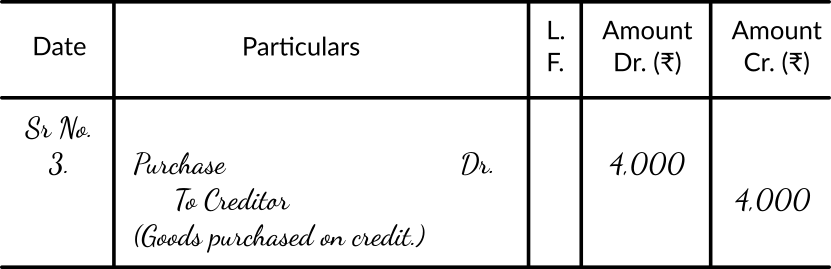

Third: Purchased more stock worth ₹4,000 on credit.

- ₹ 4,000 worth of goods (an asset) received by the business.

- Creation of a ₹ 4,000 Liability. To record liabilities, we simply record the name of the person or institution who has lent the goods to us. In absence of a name, we can simply use the generic word: Creditor/Supplier.

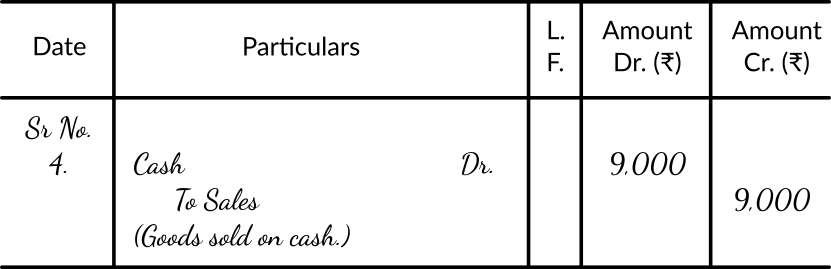

Fourth: Sold wares worth ₹6,000 at ₹9,000.

- ₹ 9,000 worth of goods (an asset) given away by the business. A decrease in asset is credited

- Cash of ₹ 9,000 received which will be debited.

Unlike accounting equation, the calculation of profit will be postponed to 31st March i.e., end of accounting year which is in line with the Periodicity Concept. For the journal entry, we’ll simply record the sale value.

Fifth: Repaid ₹2,000 to our supplier.

- ₹ 2,000 decrease in cash.

- Decrease in Liability worth ₹ 2,000.

Lastly, total both the sides to see whether they comply with the Dual Aspect Concept i.e., debits = credits.

Here, the totals of both the sides are ₹ 75,000 each i.e., debits = credits. Thus, our journal entries comply with the Dual Aspect Concept.

And, this is how we make entries into journal. By making such entries daily and analysing them on 31st March, we arrive at our two statements: Profit & Loss Statement (a.k.a. Income Statement) and Balance Sheet (a.k.a. Position Statement).

Going further, we’ll dive deep into journal and make entries for bad debts, purchase returns, bouncing of cheque, etc.

The first in this series will be Goods: Meaning & Entries.

Reference

NCERT Class 11 Accountancy Chapter 3 Recording of Transactions – I.

Leave a Reply