Till now, we have seen the following 4 types of transactions, relating to:

(1) Expense, (2) Income, (3) Asset and, (4) Liability

There’s an optional fifth kind of transaction; relating only to Equity or, the Owner’s Funds.

Recall that Balance Sheet (a.k.a., the Position Statement) is divided into two sides: Sources of Funds and Uses of Funds.

As you might now be aware, sources of funds can be primarily categorised into:

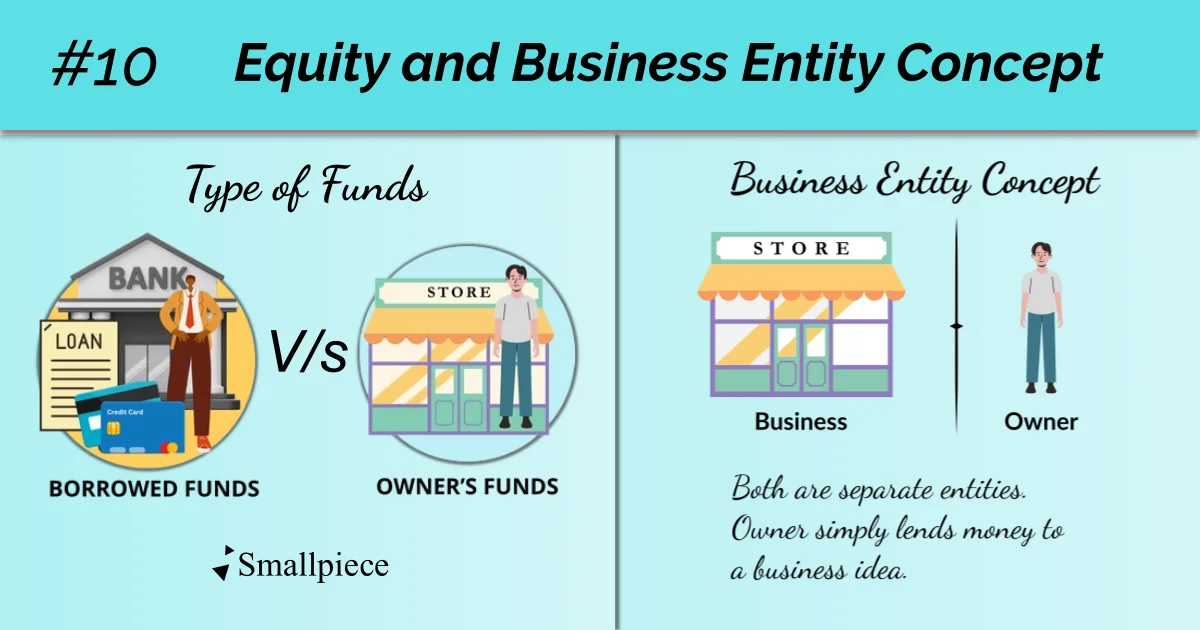

(i) Owner’s Funds a.k.a. Equity (inc., Capital + Retained Earnings)

(ii) Borrowed Funds (inc., Loans and other borrowings from third parties)

For easier understanding, I prefer to club both types of funds under the head of Liabilities, which is backed by an important accounting concept; the Business Entity Concept.

Business Entity Concept

In any form of business be it sole proprietorship, partnership, company, etc., it is assumed that the owner and his business are separate entities.

And, owner simply lends his money to a business in the hopes of making more money (or, profits).

Criticism: Differing repayment obligations

Now, some people may have valid opposition to my idea, citing the differing nature of repayment obligations on both these funds.

Borrowed Funds have fixed repayment obligations in the form of monthly instalments regardless of whether the business made profit or not. And it is possible to take action against delayed payments.

Whereas, the repayment obligations on Owner’s Funds are quite flexible or what many call volatile i.e., Owners are repaid only when there is profit, after fulfilling the interest and tax obligations. If there is bumper profit, owners who have no fixed rate enjoy the most of them and on the contrary, if there is loss, they bear it entirely.

Note that this criticism is not against the Business Entity Concept; it still remains a fundamental concept in the field of accounting. Rather, the criticism is against my idea of using it to include Equity under the category of Liabilities.

Your Choice

You can decide if you want to give this 5th type of transaction a place in your memory. Though, one solution may be to be simply call the 4th type of transaction as Equity-Liabilities (both work the same so, why not club them?).

My purpose here, was to simply introduce you to the Business Entity Concept and the two primary sources of Funding for a Business: Owner’s Funds and Borrowed Funds.

Now that we have a good understanding of the basic transactions that occur in any business, we can start with learning how we record them in journal.

Reference

NCERT Class 11 Accountancy, Topic 2.2.1 –

https://ncert.nic.in/ncerts/l/keac102.pdf

Leave a Reply