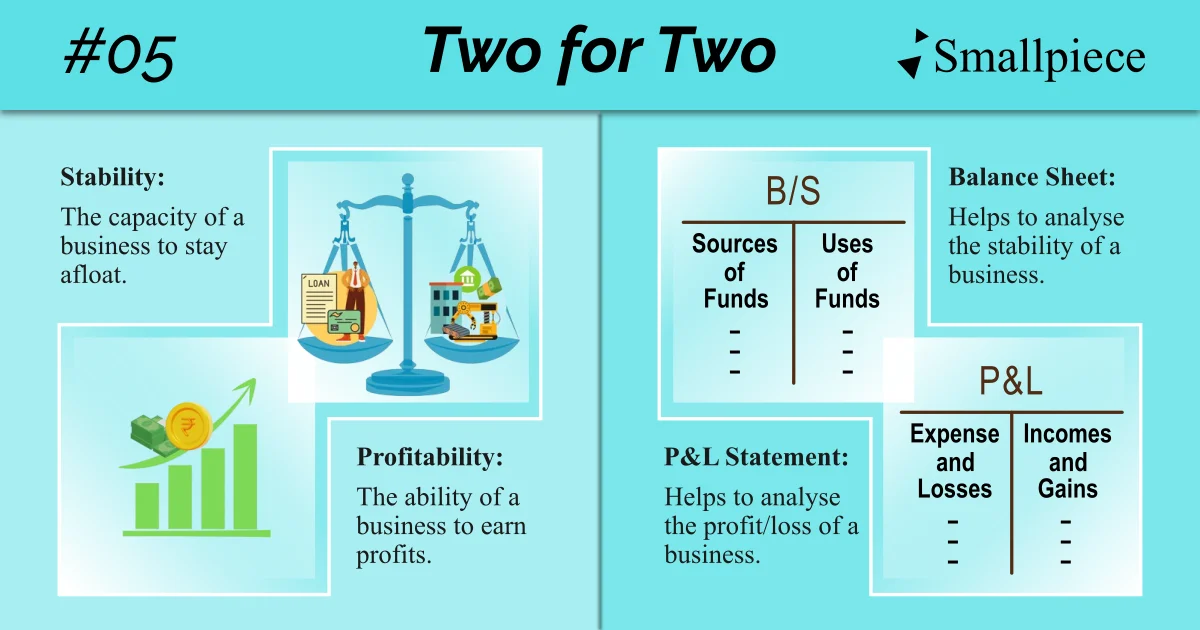

With a clear goal in mind, we have two aspects or rather, two problems to deal with: (i) Stability and (ii) Profitability.

To resolve these two problems, we make use of two tools which, in accounting terms, refer to the two ‘financial statements’.

The profitability of a business is assessed through the help of something called the ‘Income Statement’ or, the ‘Profit & Loss Account’.

And for stability, we have the ‘Position Statement’ or, the ‘Balance Sheet’.

Balance Sheet

Balance sheet is the year-end snapshot of the business activities which describes the following:

- Sources of funds invested in business (Own money, Loan, etc.)

- What you did with it i.e., Uses of Funds (Purchasing Machinery, Stock of Goods, etc.) and,

- The verdict: Profit / Loss, which appears along with the Sources of Funds.

Income Statement

Income Statement, as the name suggests, covers incomes and expenses of our business during the course of the accounting year i.e., from 1st April to 31st March.

Profit / Loss, in Balance Sheet, appears as a single figure only. But if we want to assess the profitability (i.e., the ability of the business to earn profits), we must have a detailed breakdown of all the incomes and expenses giving rise to the profit / loss.

With a detailed list, it is possible to take decisions in regards to ‘Minimizing Costs & Maximizing Gains’.

But, both the Balance Sheet and the Income Statement are simply the end results pulled from our accounting records. The question is: Where exactly are the records kept?

Probably in some kind of a Book or a Diary, right?

Is it like a normal diary or something different?

To find out, read ‘The Diary of Business’ by pressing next.

Leave a Reply