The earlier Special Entries post covered transactions where a reduction in goods occurred not due to the their sale but for advertisement, charity, loss by fire, etc.

Special Entries Two will focus more on incomes / gains and expenses / losses.

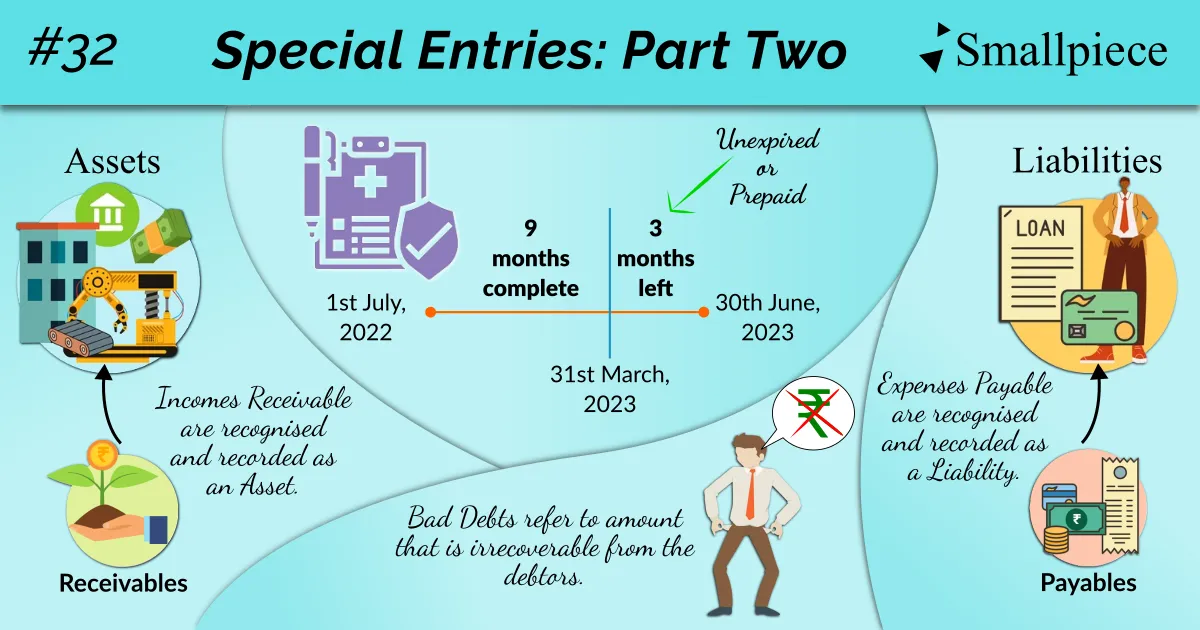

1. Bad Debts

Much of the trade in the business world is carried out on credit i.e., without making instant payments. Now, this credit trade is the same as taking a zero-interest loan. The only notable differences are that it is taken not from a bank but from a supplier and instead of hard cash, the item lent to us is goods.

Banks, when assessing their loans, use terminologies like good loans i.e., loans that are repaid timely and bad loans i.e., loans that are not repaid timely & have a high likelihood of default.

Similarly, when we assess our debtors, there are Good Debts and there are Bad & Doubtful Debts.

Bad Debts, as you can now guess, refers to the amount irrecoverable from the debtors. Bad Debts are, of course, a ‘loss’ for the business and recording them is technically called as “writing off bad debts”.

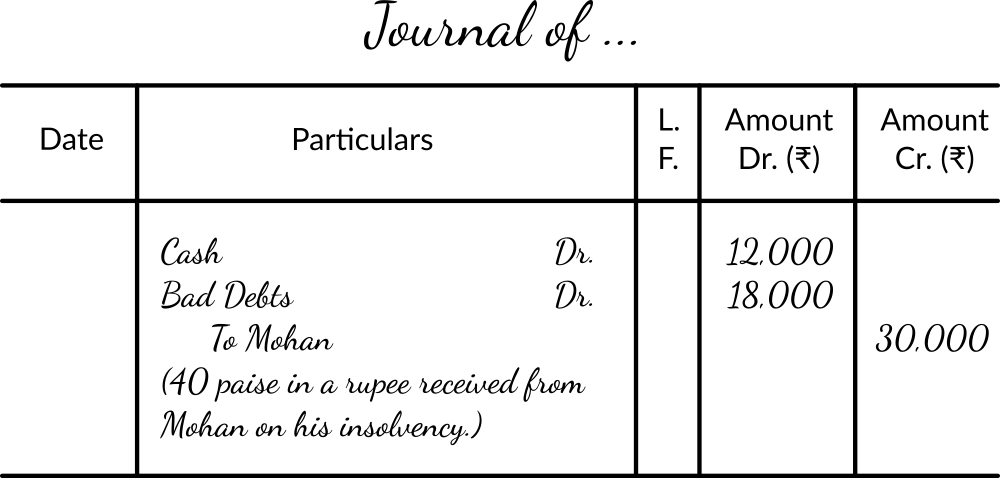

Suppose, Mohan who owed us ₹ 30,000 became insolvent and 40 paise in a rupee (i.e., 40%) is received from his estate; rest to be written off as bad debts.

The journal entry will be as follows:

2. Bad Debts Recovered

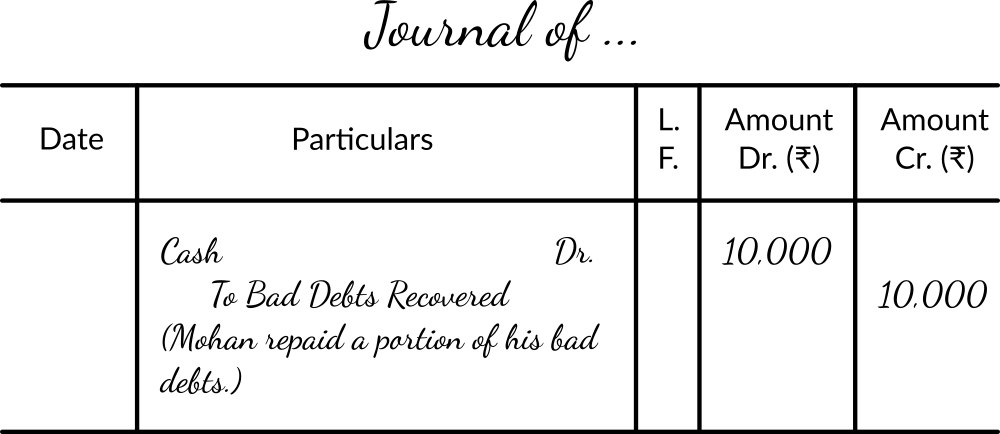

Sometimes, it so happens that the bad debts previously written off are recovered. Possible reasons to do this may be honesty, restoring reputation in the market before starting a new business, etc.

Say that one day, Mohan comes to our shop and returns ₹ 10,000 out of the ₹ 18,000 he couldn’t pay earlier. He may be motivated by either of the above reasons but, what we must do is pass a journal entry, illustrated as under:

3. Accrued Income or Income receivable

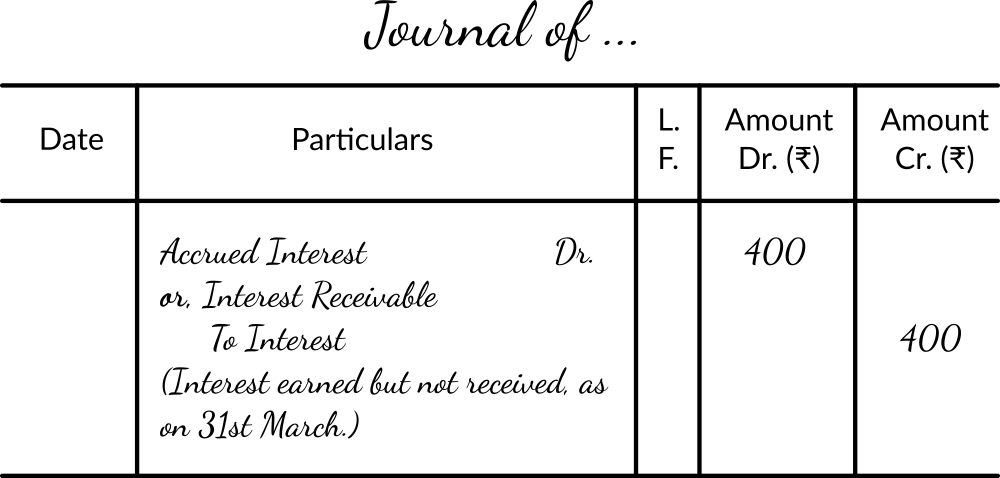

It is income receivable in the next accounting year i.e., after 31st March.

Suppose, you have invested some money on 1st February and you will be paid ₹600 as interest every quarter i.e., every 3 months. The first time you would be eligible to get this ₹600 is on 1st May. But, the books of accounts are closed on 31st March every year.

So, what about the interest for February & March that got accumulated before being due for payment? Should it be left unrecorded?

Of course not! As we saw in our last discussion on the Accrual concept, income receivables are treated as assets and thus, can be recorded by being tagged debit, in place of the Cash or Bank item, had they been received.

Why 400? Because out of the 3 months (viz., February, March & April), interest for only 2 months is earned in the current accounting year ending 31st March. The interest for April is income which will arise in the next accounting year and recorded in the same.

4. Outstanding Expenses or Expenses Payable

Sometimes, it so happens that we fall behind on our payments owing to shortage of funds or, you just forgot to pay your light bill. Such unpaid expenses are what we call Outstanding Expenses in accounting terminology.

And also in the Accrual Concept, we saw that expenses payable are treated as liabilities and thus, can be recorded by being tagged credit, to replace the cash or bank item, had the expenses been paid for.

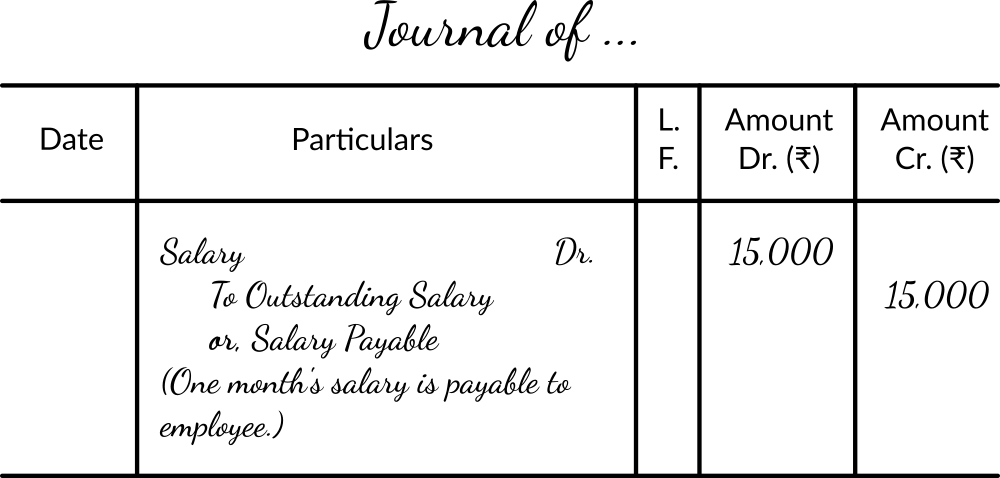

E.g., an employee’s salary is ₹ 15,000 per month. At the end of the year, he has been paid ₹ 1,65,000 (i.e., 15,000 x 11). His salary for the last month is still unpaid.

The entry for this will be made as under:

5. Prepaid or Unexpired Expenses

These are future expenses which have been (in part, or full) paid for in advance.

Prepaid expenses are ones where we will start receiving the related benefits / services from the next accounting year. Whereas, Unexpired expenses denote ongoing receipt of benefits, a portion of which, will remain valid after 31st March.

Apart from this, there are no noteworthy differences and their accounting treatment is one and the same. Thus, even if we stick to the word ‘Prepaid’ for accounting entries, it won’t be a big issue.

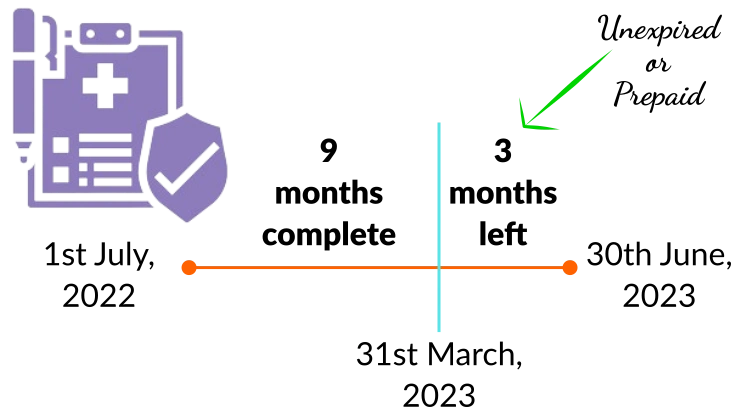

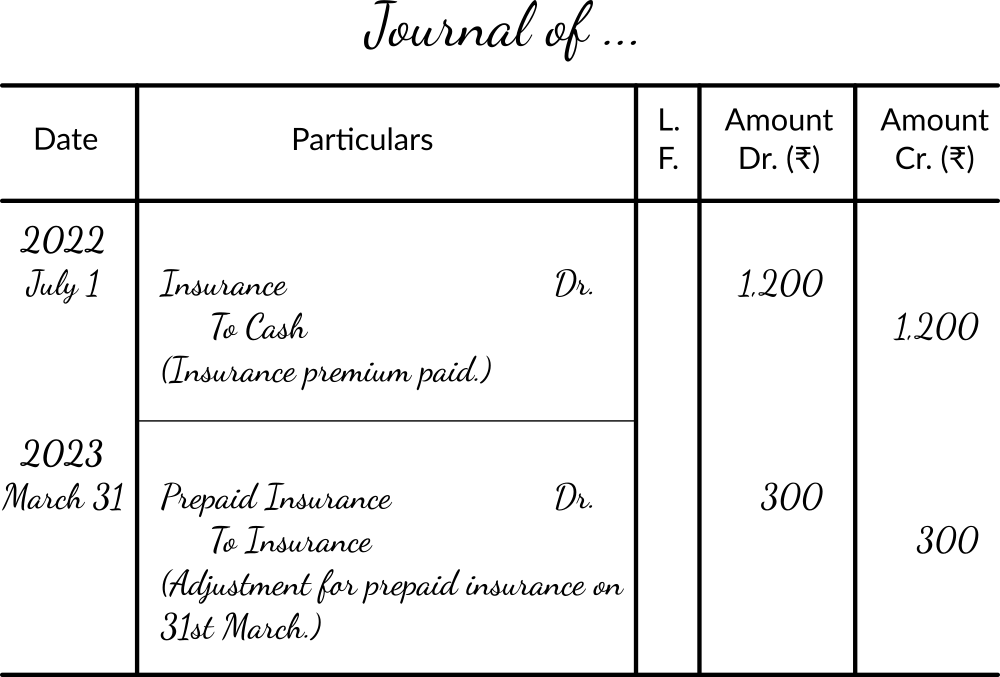

Now let us take an example. Suppose, we have paid insurance premium of ₹1,200 on 1st July 2022 for a period of one year (effectively, ₹100 per month).

Here, the accounting year 2022-23 will end with the 31st of March, 2023. But, the insurance premium for the 3 months of April, May and June will still be valid after the end date. This portion of the expense will be treated as an asset and may be recorded through the terminology of ‘Prepaid Insurance’ (which is Unexpired Insurance to be accurate but as said earlier, we will stick to Prepaid for the sake of simplicity).

6. Unearned Income or Income Received in Advance

Unearned income means income received before the sale of goods is made or particular services are provided. This, in simpler terms, is called ‘income received in advance’.

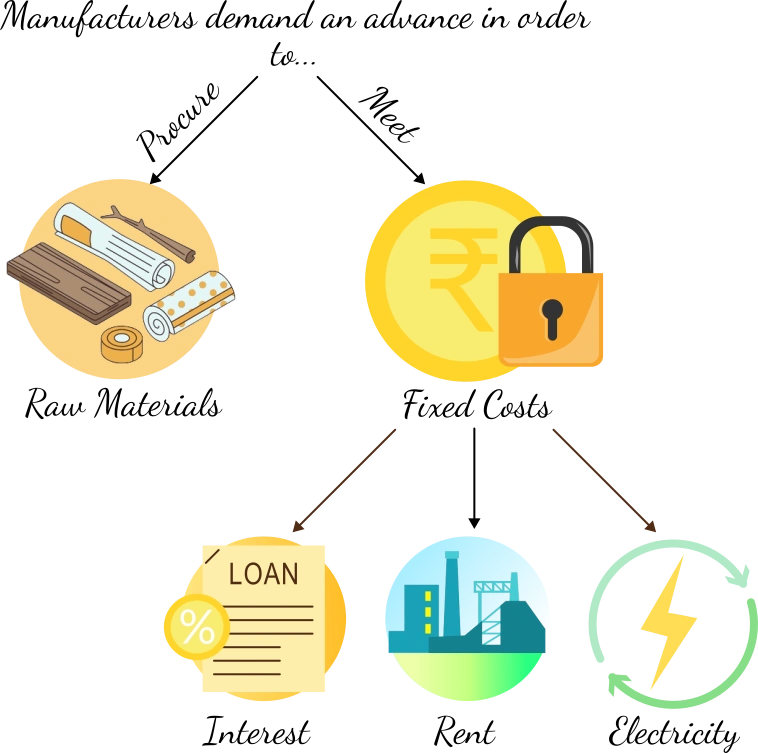

Normally, manufacturers demand a percentage (say, 25%) of the total order in advance to procure the required raw materials in bulk and meet the fixed costs (e.g., rent, electricity) in production activity. The balance (i.e., 75%) is payable on the dispatch of requested goods or any other condition agreed upon by the concerned parties.

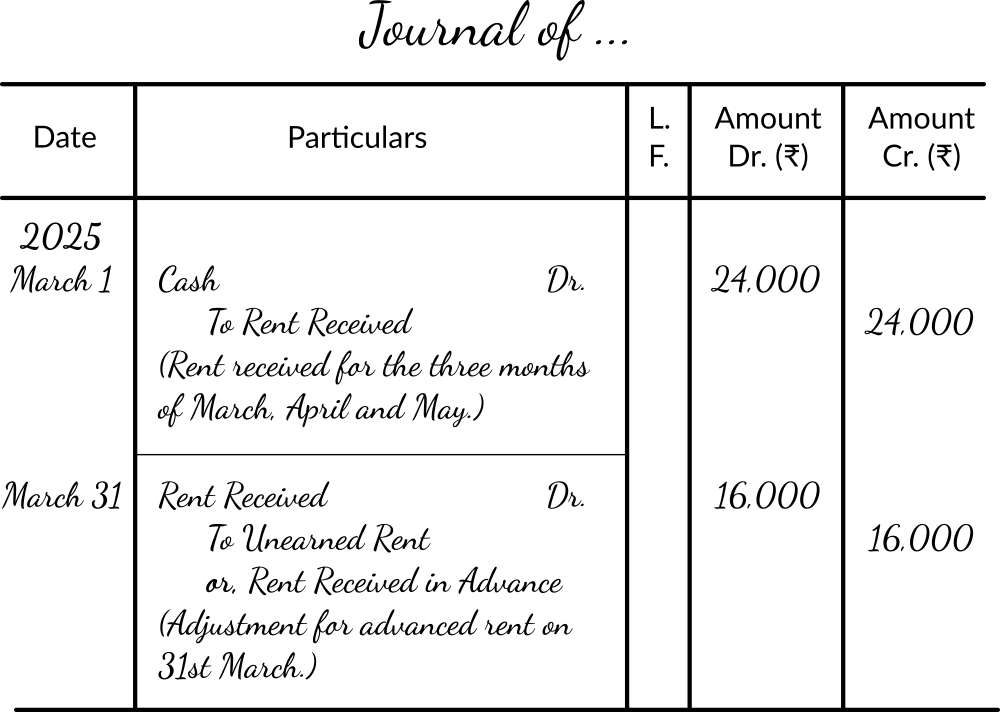

Aside from the above example of manufacturers demanding an advance, another common example may be rent received in advance. Many-a-times, in rental agreement, the landlords / property owners demand an advanced rent for a few months. Or, it may be that the tenant makes advance payment(s) to remain free of the rent burden for some time.

Regardless of the reason, the landlords have a responsibility / obligation to provide their rental services till the time period for which advance is received. Hence, any such income received in advance is a liability. In general words, it can also be said that any advance remains unearned and a liability till the promised goods / services have been provided.

To further elaborate on the rent example, let us bring in some dates and figures. Say, on 1st March, some landlord has received rent for a period of three months. This will be accounted for in a manner similar to prepaid insurance. First entry will be of the receipt of income and second will be the adjustment for unearned income on the 31st of March.

If we were to take this example from the perspective of a prepaid expense, we get yet another way of making entries for prepaid entries, similar to digital wallets. First, recording the prepaid rent and then deducting the rent amount monthly as use of the prepaid amount / wallets. For more detail, do explore the article linked in the Further Reading section.

Depreciation – to be continued…

Last in this second instalment of Special Entries is Depreciation which means the gradual decrease in the value of an asset over time due to its usage.

But, this concept merits a small discussion of its own and thus, will be taken up in a subsequent post.

Further Reading

1. Deduction of a fixed amount monthly on a fixed time frame from the total advanced expenses.

cleartax – https://cleartax.in/s/what-is-prepaid-expenses

Leave a Reply